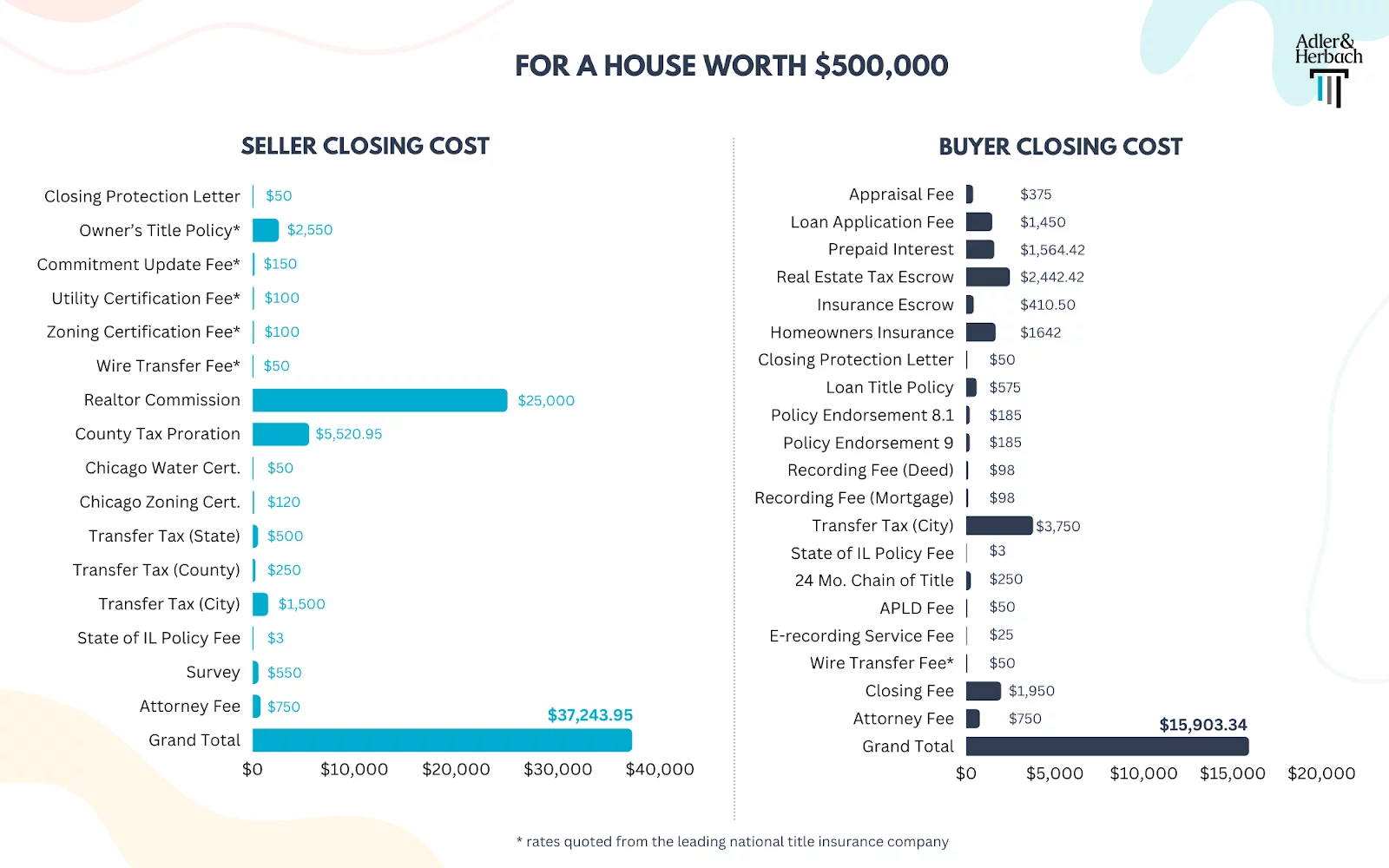

When purchasing a home in Illinois, buyers and sellers must pay certain closing costs to finalize the real estate transaction. But who pays which fees? Closing costs can range from 3-8% of the total purchase price, so it’s important for buyers and sellers to understand their responsibilities.

Who pays the closing costs on a House?

In Illinois, both buyers and sellers typically share the responsibility of paying closing costs on a house. Sellers generally pay for real estate agent commissions, title insurance, transfer taxes, and seller’s attorney fees. On the other hand, buyers are responsible for expenses such as loan origination fees, appraisal fees, and prepaid property taxes.

However, these costs can be negotiable, and there are ways to reduce them, such as shopping around for lenders, negotiating with the seller, and taking advantage of lender programs or discounts.

Find Your Home’s Maximum Value with Our Essential Seller’s Guide!

Tailored exclusively for home sellers seeking to navigate the market with confidence and secure the best possible deal.

- Top 12 Estimators Unveiled: Cut through the clutter with a curated comparison, empowering you to choose the right tool without hassle.

- Clear, Actionable Insights: Simplified breakdowns translate complex tools into actionable knowledge, accelerating your journey to the right price.

- Strategic Pricing Mastery: Master the art of pricing, ensuring your home stands out to buyers while maximizing your profit.

- Tested and Proven Advice: Benefit from real-world assessments and proven strategies that streamline your sale, from listing to closing.

- Trusted by Your Neighbors: Join a community of local homeowners who’ve turned insights into action and success.

- The Key to a Lucrative Sale: Equip yourself with insider knowledge that transforms the selling process, ensuring you walk away with more.

What Are Closing Costs?

Closing costs refer to the various fees and charges associated with finalizing a real estate transaction. They are paid at closing, when the property sale is settled and the keys are handed over. Closing costs cover services needed to legally transfer ownership and protect the interests of the parties involved.

Closing costs can vary significantly based on factors like home price, location, lender, and more. On average, buyers and sellers in Illinois each pay 3-4% of the purchase price in closing costs. Being aware of the typical fees involved can help both parties prepare financially and negotiate where possible.

Types of Closing costs

Typical closing costs in Illinois fall into two main categories:

- Lender costs include fees for originating and underwriting a mortgage loan.

- Third-party costs, on the other hand, include expenses related to the title search, appraisal and home inspection of the property, among others.

Lender Costs

- Loan origination fee

- Discount points

- Credit report fee

- Appraisal fee

- Underwriting fee

- Processing fee

- Mortgage insurance premium (Private Mortgage Insurance)

- VA funding fee

- Tax service fee

- Flood certification fee

Third-Party Costs

- Appraisal fees

- Title search fee

- Title insurance

- Survey fees

- Attorney fee

- Home inspection fees

- Homeowners Association (HOA) fees

- Escrow fees

- Recording fees

- Transfer taxes

- Courier fees

For Buyers

Be savvy about closing costs with our professional legal advice. Make sure you’re getting the best deal!

For Sellers

Save 50% on title fees with Adler & Herbach! Maximize your sales profit with our expert guidance on handling closing costs.

Call now & Get a Free Consultation!

Special Offer: Mention this website and get a free consultation on your first service!

How much are closing costs on a house?

Closing costs on a house typically amount to 3-8% of the purchase price.

- For buyers, this means paying around $9,000 to $12,000 for a $300,000 home.

- Sellers, on the other hand, face expenses like real estate agent commissions (5-6% of sale price) and other closing fees (2-4% of sale price).

Buyers should also consider their cash to close, including down payment and upfront expenses, which can range from 2% to 5% of the purchase price.

What are the Closing costs for the seller?

In Illinois, typically, sellers are responsible for closing costs like paying the real estate agent commission, calculating county tax proration, obtaining Chicago water and zoning certificates, covering survey fees, purchasing owner’s title insurance, paying transfer taxes (county, state, and city), and covering attorney fees for legal services.

Find Your Home’s Maximum Value with Our Essential Seller’s Guide!

Tailored exclusively for home sellers seeking to navigate the market with confidence and secure the best possible deal.

- Top 12 Estimators Unveiled: Cut through the clutter with a curated comparison, empowering you to choose the right tool without hassle.

- Clear, Actionable Insights: Simplified breakdowns translate complex tools into actionable knowledge, accelerating your journey to the right price.

- Strategic Pricing Mastery: Master the art of pricing, ensuring your home stands out to buyers while maximizing your profit.

- Tested and Proven Advice: Benefit from real-world assessments and proven strategies that streamline your sale, from listing to closing.

- Trusted by Your Neighbors: Join a community of local homeowners who’ve turned insights into action and success.

- The Key to a Lucrative Sale: Equip yourself with insider knowledge that transforms the selling process, ensuring you walk away with more.

These costs ensure a smooth and legally compliant transaction.

1. Real estate agent commission

A fee paid to the agent who assists in the sale or purchase of the property. This fee is typically a percentage of the total sale price.

2. County tax proration

A calculation of the property taxes that are owed at the time of the sale. This calculation ensures that both the buyer and the seller are paying their fair share of property taxes based on the time that they own the property.

3. Chicago water and zoning certificate

In Chicago, it is also common to require a water certificate and a zoning certificate, which are certifications that the property is up to code with respect to its water and zoning regulations.

4. Survey fees

Fees for a professional surveyor to measure and map the property boundaries.

5. Owner’s Title Insurance

A type of insurance that protects the buyer from any potential claims against the property’s title.

6. Transfer taxes (County, State and City)

Transfer taxes are taxes paid by the buyer when ownership of a property is transferred from one party to another. These taxes are typically imposed by the state, county, and/or city government and are calculated as a percentage of the sale price of the property.

7. Attorney fees

Fees for legal services provided by an attorney to ensure that the transaction is legally sound and to protect the interests of the parties involved.

Average Closing Costs For Sellers

The typical closing costs paid by home sellers in Illinois are around $4,538. This is based on the average home value in the state of $228,698 and the average total cost to sell being 7.14% of the sale price. Of that 7.14%, 5.24% goes to the real estate agent commission and 1.9% covers the seller’s closing costs.

While the statewide average is $4,538, the specific closing costs can vary significantly by location within Illinois.

Sellers may split costs with buyers in some areas, while sellers may pay a different amount in other cities like Naperville and Aurora compared to the state average. The closing costs are dependent on factors like home value and local practices.

Does Buyer Pay Closing Costs on a House?

In Illinois, the buyer usually pays the closing costs, which are around 3-4% of the home’s price. The buyer pays for things like title insurance, fees to get the mortgage, and taxes.

For example, with a $208,429 house, the buyer’s closing costs are about $1,955 and the seller’s closing costs are around $4,538.

- The exact amount changes based on the location and price of the house.

- The buyer and seller can negotiate who pays what and it depends on the real estate deal.

The buyer might be able to include the costs in their mortgage loan. But they should be ready to pay the costs when they close on the house if needed. They will also need funds for the down payment and other upfront expenses.

What are the Closing costs for the Buyer?

Closing costs for the buyer in a real estate transaction can include loan origination fees, appraisal fees, credit report fees, prepaid interest, homeowner’s insurance, lender’s title insurance, policy endorsements, transfer tax, attorney fees, home inspection fees, mortgage insurance premiums, recording fee for the mortgage, and closing fees. These expenses are typically paid by the buyer but can be negotiable. The responsibility for paying them may vary depending on the terms of the real estate contract.

Home Buyer’s Essential Guide

Get the Secrets to a Smooth Home Buying Experience!

Expert-Curated Guide:

- 43-page, mobile-friendly guide for first-time home buyers.

- Covers all aspects from mortgage acquisition to home settlement.

- Touted as the only needed guide for homebuyers.

- Widely praised by locals.

1. Loan origination fees:

These are fees charged by the lender for processing a loan application and setting up a loan. They are usually expressed as a percentage of the loan amount.

2. Appraisal fees:

An appraisal is an evaluation of the property’s value, and the fee to cover the cost of it is charged to the borrower.

3. Credit report fees:

Lenders require a credit report to determine a borrower’s creditworthiness, and the fee for obtaining this report is charged to the borrower.

4. Prepaid Interest:

This refers to the interest that accrues between the date of the loan closing and the end of the first month of the loan term.

5. Homeowner’s insurance:

Lenders require borrowers to carry homeowner’s insurance to protect the property and the lender’s investment in the property.

6. Lender’s Title insurance:

Title insurance protects the lender’s interest in the property and is required by most lenders.

7. Policy endorsement:

Endorsements are additions to the title insurance policy that provide additional coverage beyond the basic policy.

8. Transfer tax (City):

Fees charged by the government when ownership of the property is transferred from one party to another. In some cases (including the City of Chicago), the city may charge a transfer tax in addition to the county or state transfer tax.

9. Attorney fees:

The buyer may choose to hire an attorney to review the closing documents and ensure that their interests are protected. In that case, the buyer’s attorney’s fees are paid by the buyer.

10. Home inspection fees:

A home inspection is an evaluation of the property’s condition, and the fee for this evaluation is charged to the buyer.

11. Mortgage insurance premiums:

Mortgage insurance is required for some loans, particularly those with low down payments, and the fee is charged to the borrower to cover the cost of this insurance.

12. Recording fee (Mortgage):

A fee charged by the county recorder’s office to record the mortgage lien on the property.

13. Closing fee:

A fee charged by the title company or closing agent for conducting the closing.

How to Reduce closing costs?

To reduce closing costs when buying a home, compare lenders, negotiate with the seller, look for discounts, consider a no-closing-cost mortgage, review the loan estimate, close at month-end to lower prepaid interest, and avoid unnecessary fees by doing tasks yourself and requesting fee waivers.

1. Shop Around for Lenders

The fees charged by lenders vary, so it is worth taking the time to compare different lenders to find the one that offers the best rates and fees. You can start by getting quotes from at least three different lenders and comparing the closing costs of each.

2. Negotiate with the Seller

Some sellers may be willing to pay a portion of the closing costs to close the deal. This is especially true in a buyer’s market where there is less competition for homes.

If you’re working with a real estate agent, they can help you negotiate with the seller to reduce the closing costs.

3. Look for Discounts

Some lenders offer discounts on closing costs for certain groups, such as military veterans or first-time homebuyers. You can ask your lender if they offer any discounts and if you qualify for them.

Some lenders may offer promotions from time to time that can reduce your closing costs. Keep an eye out for these promotions and take advantage of them if you can.

4. Choose a No-Closing-Cost Mortgage

These mortgages allow you to roll the closing costs into the mortgage itself, so you don’t have to pay anything upfront. However, keep in mind that this can increase your monthly payments, and you will end up paying more interest over the life of the loan.

5. Ask for a Loan Estimate

A loan estimate is a document that lenders are required to provide to borrowers within three business days of applying for a loan. It details the loan terms and estimated closing costs.

Be sure to review the loan estimate carefully and ask your lender about any fees or charges that you don’t understand. This can help you identify any unnecessary fees and negotiate with the lender to reduce or eliminate them.

6. Close at the End of the Month

The interest on your mortgage is prorated from the day of closing until the end of the month. If you close at the beginning of the month, you will have to pay more interest upfront.

By closing at the end of the month, you can reduce the amount of prepaid interest you have to pay at closing.

7. Avoid Unnecessary Fees

Finally, one of the best ways to reduce closing costs is to avoid unnecessary fees. For example, you can save money by doing some of the work yourself, such as shopping around for homeowners insurance.

You can also ask your lender to waive certain fees, such as application fees or processing fees.

Who Pays the Closing Costs on A VA Loan?

For a mortgage financed through a VA loan, the borrower (buyer) is typically responsible for paying a VA funding fee, which is between 1.4% – 2.3% of the total loan amount. Certain veterans, such as those receiving disability compensation, are exempt from paying this fee.

While the VA funding fee may seem high, VA loans offer benefits that can offset the costs. For example, the fee can be rolled into the loan instead of paid upfront. Also, VA guidelines limit many lender fees like origination, processing, and document fees. This allows the buyer to potentially negotiate with the seller to pay for other closing costs typically paid by the buyer. Overall, VA loans can be a great option for eligible veterans.

Who Pays Closing Costs on a cash Sale?

In an all-cash home sale with no financing, the buyer avoids all lender-related closing costs. The closing/escrow fee is usually split between buyer and seller. The buyer pays for inspection, transfer taxes if applicable, recording fees, and some title company service fees. The seller covers the bulk of costs like real estate commission, their half of escrow fee, title insurance premiums, survey, transfer taxes, and additional title company fees. The exact breakdown depends on the contract terms. Reviewing costs before signing is key.

What Are Seller Concessions And How do They Help?

Seller concessions are when the seller agrees to cover a portion of the buyer’s closing costs, which can be very helpful for buyers lacking sufficient funds at closing. It makes the property more enticing to buyers, allowing the seller to potentially sell faster. Concessions are negotiable but subject to limits based on loan type. Overall, concessions bridge the gap in closing costs and facilitate the transaction.

What Closing costs can you negotiate?

When buying a home in Illinois, certain closing costs may be negotiable between the buyer and seller. Here are some examples:

- Title insurance fees – The buyer and seller can agree to split the cost of title insurance 50/50 or come up with an alternative arrangement.

- Escrow fees – The escrow or closing fees charged by the title company can often be split between the parties.

- Transfer taxes – The local and state transfer taxes can potentially be paid for by the seller rather than the buyer.

- Inspection fees – The seller may agree to cover the cost of the property inspection report.

- Origination fees – If the seller offers closing cost concessions, origination fees could be covered.

- Prepaids – Property taxes, HOA dues, insurance, etc. may be negotiable.

Consult real estate attorneys to ensure any negotiations stay within legal limits and make sense financially. Negotiating closing costs requires strategic thinking and planning. Be sure to weigh the trade offs and understand increased costs down the line before agreeing to any concessions.

Additionally, some lenders offer no-closing-cost mortgages that roll fees into the loan balance, reducing upfront costs but possibly increasing long-term costs. Shop around to find the best option.

Call now & Get a Free Consultation!

Special Offer: Mention this website (Northsidelegal.com) and get a free consultation on your first Real estate attorney service!

What is a no-closing-cost mortgage?

A no closing cost mortgage is a home loan where the borrower does not have to pay any of the typical upfront fees associated with getting a mortgage, such as origination fees, appraisal fees, and title insurance. The lender covers these costs instead.

However, the lender will often roll the fees into the loan balance or charge a slightly higher interest rate. This means the borrower may end up paying more over the long run, even if they don’t have to pay a lot at closing.

Borrowers are still responsible for other closing costs like prepaid interest, property taxes, and insurance. So while a no closing cost mortgage can be helpful for some, weigh the pros and cons to decide if it makes sense long-term.

The Bottom Line

When buying or selling a home in Illinois, closing costs are a key consideration. Both buyers and sellers can expect to pay around 3-4% of the purchase price in various lender fees, third party charges, transfer taxes, and more.

Sellers generally cover commissions, title insurance, and attorney fees while buyers pay loan origination, appraisals, and prepaid taxes. However, some costs are negotiable and programs exist to reduce fees.

Talk to real estate professionals to understand your options. With the right preparation and negotiation strategy, buyers and sellers can manage closing costs effectively.