For aspiring homeowners in Illinois, one key question is: “How much is a down payment on a house?” The down payment amount varies based on your loan type, home price, and other factors.

1. What is a Down Payment?

A down payment is the upfront cash you pay towards buying a home. It’s a percentage of the total purchase price, paid at closing. This gives you instant equity in the home. The remainder of the price is financed with a mortgage loan.

How much you need for a down payment depends on:

- Your credit score and financial position

- The mortgage loan program you use

- The total price of the home

- Lender requirements

In Illinois, required down payments often range from 3% to 5% of the home purchase price for conventional loans. 3.5% for FHA loans. No down payment is required for VA and USDA loans. To avoid paying monthly insurance premium 20% down payment is required.

Let’s see all of these and a lot more in detail in this article.

2. How Much is a Down Payment on a House?

The down payment on your primary residence would generally be 3.5% if you go with FHA loan. With conventional loans the down payment on a house would be 3 to 5%. If your credit score is higher than 620, you can get mortgage loans with lower down payment. To avoid paying private mortgage insurance (PMI), you would have to pay 20% down payment.

For example,

- If you’re purchasing a $500,000 home in Illinois and are required to make a 10% down payment, you’ll need to have $50,000, plus closing costs, available at the time of purchase.

- Similarly, if you’re purchasing a $300,000 home and you’re required to make a 20% down payment, you’ll need to have $60,000, plus closing costs.

The amount of money you’ll need for a down payment depends on the purchase price of the home and the type of loan you’re using. If you’re using a government-backed loan such as FHA or VA, you can qualify for a lower down payment, sometimes as little as 0% down.

You can use this mortgage payment and down payment calculator to estimate the costs of your mortgage loan. Also learn more about Cash to close ‘To Borrower’.

3. How Much Should you Put Down on a House?

You should put down at least 20% down payment on a house. Sellers prefer such buyers giving you an edge over other buyers. 20% down payment shows lenders that your finances are in order. So you can easily find a mortgage lender especially in a competitive market.

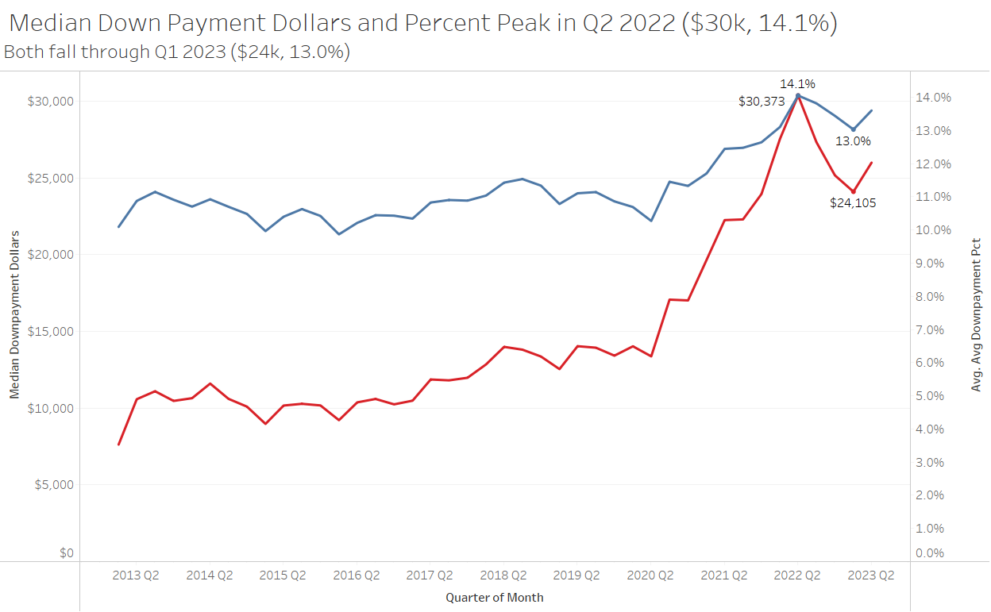

4. How Much do most First-time Home buyers Put Down?

Most of the first time home buyers in USA put down 13% down payment on their home’s purchase price in the first quarter of 2023, according to realtor. Although you’ll have to put down 20% down payment not to pay PMI and to get your home offers accepted easily.

5. How Much Down Payment for Investment Property?

The down payment for investment property ranges from 15% to 25% typically. Most investors make. adown payment between 20 to 25%. Investment property loans with higher loan to value ratio (LTV ratio) have higher interest rate and loan fees.

Down payment vs Closing costs

While a down payment represents the upfront portion of the purchase price, closing costs are expenses incurred during the purchase process.

- Closing costs on a house can include attorney fees, points, appraisal fees, home inspection fees, title fees, title insurance cost, transfer taxes and more.

- While the down payment is paid to the seller and goes toward the home’s purchase price, closing costs are paid to third-party service providers and an additional sum.

For Buyers

Be ready to secure your dream home with the right down payment. Our legal experts can answer all of your questions!

For Sellers

Give yourself peace of mind with a secure home sale. Contact our real estate attorneys for expert advice!

Call now & Get a Free Consultation!

Special Offer: Mention this website and get a free consultation on your first service!

Why do I need to make a down payment when buying a home?

You need to make a down payment when buying a home to show the seller and lender you’re financially committed to the purchase. It reduces the loan amount you need to borrow. A 20% or higher down payment avoids PMI. It builds immediate equity and improves your interest rate.

How much is a downpayment on a 300K house?

The downpayment on a 300K house is at least 3% ($9,000) or 3.5% ($10,500) of the home purchase price. If you can opt for VA loan or USDA loan the minimum downpayment is 0%. However if you put down 20% ($60,000) downpayment you can avoid paying mortgage insurance.

What to Do Before Applying for a Mortgage?

Before applying for a mortgage, check your credit, address any errors, pay down debts, maintain good payment history, verify income sources, and save funds for the down payment, closing costs, and emergency reserves. This shows lenders you are financially prepared for home ownership.

When you buy a home and apply for a mortgage, lenders will closely review your finances to ensure you can fulfill the long-term commitment. Your credit score plays a major role in qualifying for a home loan and determining required down payment.

Having a higher credit score can help you:

- Get approved for better mortgage rates and terms

- Meet loan requirements with a lower down payment

- Reduce interest costs over the life of the loan

So before submitting a mortgage application, be sure to:

- Check your current credit score and get a copy of your credit report

- Address any errors or issues on your report to improve your score

- Pay down existing debts to lower your debt-to-income ratio

- Maintain responsible credit card usage and payment history

- Verify all income sources and monthly expenses

- Save funds for the down payment, closing costs, and emergency reserves

Taking these steps improves your financial position and shows lenders you can manage home ownership long-term.

How does your Down Payment Size Affect your Mortgage?

A larger down payment when buying a house can save you money in the long run. Putting down at least 20% avoids Private Mortgage Insurance (PMI), which can add hundreds of dollars to your monthly payments. It also reduces the amount of interest you’ll pay over the years, resulting in significant savings.

1. Private Mortgage Insurance, or PMI

PMI gets tacked onto your monthly payments if you put less than 20% down. For a $300K house, 10% down ($30K) means you’ll owe PMI, which could be hundreds more per month. 20% down ($60K) lets you skip PMI, saving a ton over the life of the loan. Once you get 20% equity by paying down the loan, PMI goes away.

2. Your monthly payment amount

More down payment means lower monthly payments. For a $500K house at 6% interest, 20% down ($100K) gives you around $2,400 monthly. Just 5% down ($25K) jumps up to $2,850, plus another $135 for PMI. That’s nearly $600 extra per month! Don’t forget taxes and insurance add on too.

3. Total interest paid over the years

More down payment means less interest paid overall. For a $400K home at 6.5% interest, 20% down ($80K) leads to around $408K total interest paid. 5% down ($20K) results in about $485K interest instead – nearly an $80K difference!

What are the Minimum Down Payment Requirements for Buying a Home?

The minimum down payment for buying a home depends on the type of loan and the property’s price. For primary residences, conventional loans require 3-20% down payment. Jumbo loans typically need a 10% down payment. FHA loans require just 3.5% down, while VA and USDA loans allow for zero down payment options. For investment property, it’s usually between 15 – 25% of the purchase price.

Each loan type has its own eligibility criteria and benefits. Requirements are typically higher for a second home or investment property

1. Conventional Loans: 3 – 20%

- A conventional loan is not insured or guaranteed by a government agency. The lender takes on more risk.

- For low down payment conventional loans, the minimum downpayment is usually 3-5% of the purchase price. This gets better rates than government-backed loans.

- For a conventional loan without private mortgage insurance (PMI), the minimum down payment is 20% of the purchase price. This avoids paying PMI, which adds costs to the monthly payments.

- Once you reach 20% equity in the home through payments, PMI can be removed.

- For example, for a $300,000 home, 3% is $9,000, and 20% is $60,000.

2. Jumbo loans: 10%

- Jumbo loans are for luxury properties exceeding limits set by Fannie Mae and Freddie Mac (currently $647,200).

- They are considered high risk due to large loan amounts of $500,000+ in most cases.

- They require substantial assets and strong credit and income to qualify.

- A minimum 10% down payment is standard, but it can be higher, too, depending on the lender and property.

3. FHA loans: 3.5%

- The Federal Housing Administration insures FHA loans, part of the Department of Housing and Urban Development.

- They help lower income and first-time buyers with limited savings purchase a home.

- They require just 3.5% down and have lower credit score requirements than conventional loans.

- They are a popular option but require mortgage insurance payments added to the monthly payment.

4. VA Loans: 0%

- Backed by the Department of Veterans Affairs. No down payment required.

- Only available to qualifying military members and veterans. Useful benefit to this demographic.

- Require VA funding fee but no monthly mortgage insurance payments.

5. USDA Loans: 0%

- Backed by the U.S. Department of Agriculture. Help very low income buyers in rural areas.

- No down payment required. Can finance up to 100% of the purchase.

- Have income and location eligibility requirements.

How Much Should You Put Down When Buying a House?

Putting down at least 20% of the purchase price is generally recommended. This avoids paying private mortgage insurance (PMI) which adds cost to your monthly mortgage payments. While 20% down has advantages like no PMI, lower monthly costs, and less interest paid, other down payment amounts can work too. Explore your loan choices.

Some benefits of a larger down payment like 20%:

- Lower monthly mortgage payments

- Shorter loan repayment term

- Less interest paid over the life of the loan

However, there are scenarios where less than 20% could make sense:

- First-time homebuyers may not have enough savings yet for 20% down.

- You’d have to drain emergency or retirement funds to get 20% down.

- You have a low mortgage rate now that you don’t want to lose.

- You plan to sell the home quicker, so less overall interest paid.

What is My Debt-To-Income Ratio?

Your debt-to-income ratio (also called DTI ratio) is a percentage that lenders use to determine your ability to take on the financial obligation of a mortgage.

How to Calculate Debt to Income Ratio?

- Total up all of your monthly recurring debt payments such as credit card bills, student loan payments, auto loan payments, child support, insurance premiums, and any other debts with a regular monthly payment.

- Divide this total monthly debt amount by your gross (before tax) monthly income from all sources such as your job, side work, investment returns, etc.

- For example, if your total monthly debt payments add up to $2,000 and your gross monthly income is $6,000, your DTI is 33% ($2,000 divided by $6,000).

Lenders scrutinize your DTI ratio very closely to see if you can realistically afford the mortgage payment along with your other financial obligations.

What are Debt to Income Ratio Guidelines?

- Most lenders want your DTI to be 36% or lower to qualify for a mortgage. However, the exact DTI requirements vary by lender and loan program.

- An ideal DTI is considered 43% or less by many lenders. But some may allow a higher DTI for borrowers with very strong credit scores and substantial cash reserves.

- A high DTI over 50% often signals to lenders that you may have difficulty making timely mortgage payments. You can improve your ratio by paying down debts and finding ways to increase your income.

2 Primary Types of DTI Ratios

There are two primary types of DTI ratios lenders assess:

- Front-end DTI specifically compares housing expenses like mortgage, property tax, insurance to your income.

- Back-end DTI looks at your total debts including housing expenses vs. income.

What Documents does the Lender Require to Verify your Down Payment Funds?

When applying for a mortgage loan, you will need to provide documents to satisfy the lender that you have sufficient funds available to make the down payment and make monthly payments:

- Bank statements for your checking, savings, and any other accounts you will use for the down payment funds. You will need to provide 2-3 months of statements showing average balances that can cover the down payment amount.

- Pay stubs showing your regular income amounts. Provide 2-3 months of recent, consecutive pay stubs from all your jobs.

- W-2s or tax returns from the last 2 years to verify your income amounts and employment history.

- A letter from your current employer verifying length of employment and salary.

- Documentation like a gift letter if any portion of the down payment funds will come from a monetary gift.

- Valid photo ID such as a driver’s license or passport to confirm your identity.

- Proof of your physical address such as a utility bill or lease agreement.

Always check with the specific lender on what documents they require for the mortgage application and down payment verification process. Be thorough and provide ample documentation.

Call now & Get a Free Consultation!

Special Offer: Mention this website (Northsidelegal.com) and get a free consultation on your first Real estate attorney service!

FAQs related to Down Payment on a House

1. Can you buy a house without making a down payment?

While it is possible to buy a house without a down payment, it is uncommon and may not be ideal for most homebuyers. Certain government-backed mortgage programs allow for no down payment, like VA and USDA loans. But you must meet eligibility requirements.

- VA loans are for veterans, active military, and surviving spouses. USDA loans help low and moderate income buyers in rural areas. With both, you can finance 100% of the home purchase without a down payment.

2. Do you need a 20% down payment to buy a house?

Actually, there are several loan programs that allow less than 20% down:

- FHA loans only need a 3.5% down payment.

- VA and USDA loans need 0% down.

- Some conventional loans accept down payments as low as 3%.

So 20% down is not required, but does have financial benefits.

3. Is 5-10% down payment enough?

While 5-10% down is enough to get a mortgage, consider the long term costs:

- You’ll likely owe PMI, adding monthly costs.

- Less equity means harder to tap home later for loans.

- More interest paid over the full loan.

4. Do low down payment mortgages rip you off?

Loans with less than 20% down payments come with tradeoffs:

- Yes, the lower down payment is easier upfront.

- But you’ll pay higher interest rates over the life of the loan.

- Most also require PMI, adding hundreds more per month.

- So you end up paying much more in the long run.

5. When do you need the down payment money?

You need the down payment funds in your account by closing, typically 30-45 days after signing the purchase agreement. Save diligently in advance.

6. Where can you get money for the down payment?

If short on savings, consider:

- Down payment assistance programs and special loans

- Withdrawing from existing savings accounts

- VA, USDA, or other low down payment mortgage options

- Be aware added fees and costs with some options

7. How does your credit score impact the down payment?

The higher your credit score, the lower down payment you’ll need. For example:

- 580+ credit score means just 3.5% down on an FHA loan.

- Below 580 score may require 10% down minimum.

8. What can I do to improve my credit scores?

Building good credit scores takes time and effort. But it’s worthwhile, as higher scores get you better loan terms. Here are 5 tips:

- Pay all bills on time each month. Set up autopay or reminders to avoid missed or late payments.

- Pay down existing debts to lower amounts owed. Target high credit card balances first.

- Correct any errors on your credit reports by disputing them. Mistakes can negatively impact your scores.

- Keep credit card balances low compared to limits. High “utilization ratios” lower scores.

- Open new credit accounts carefully. Too many new accounts can signal risk and hurt scores.

Check your credit reports regularly and monitor score changes. Be patient and persistent in building great credit.

The Bottom Line

Making a down payment to buy a house is a big financial commitment requiring advance planning.

In Illinois, typical down payments range from 5% to 20% of the purchase price, depending on your loan program. Options like FHA, VA, and USDA loans allow lower down payments for those who qualify.

Be sure to research different loan types, mortgage insurance costs, and closing fees. Compare options to find the best fit for your budget and financial situation.

Speaking with a lender can provide guidance on down payment size and loan programs. Planning ahead and saving sufficiently for your down payment is key to making homeownership attainable.