Purchasing a home represents one of the biggest financial investments most people will ever make in their lifetimes. To protect this major investment, buyers in Illinois commonly purchase title insurance during the home buying process. But how much does title insurance cost in the state of Illinois?

How Much is Title Insurance in Illinois?

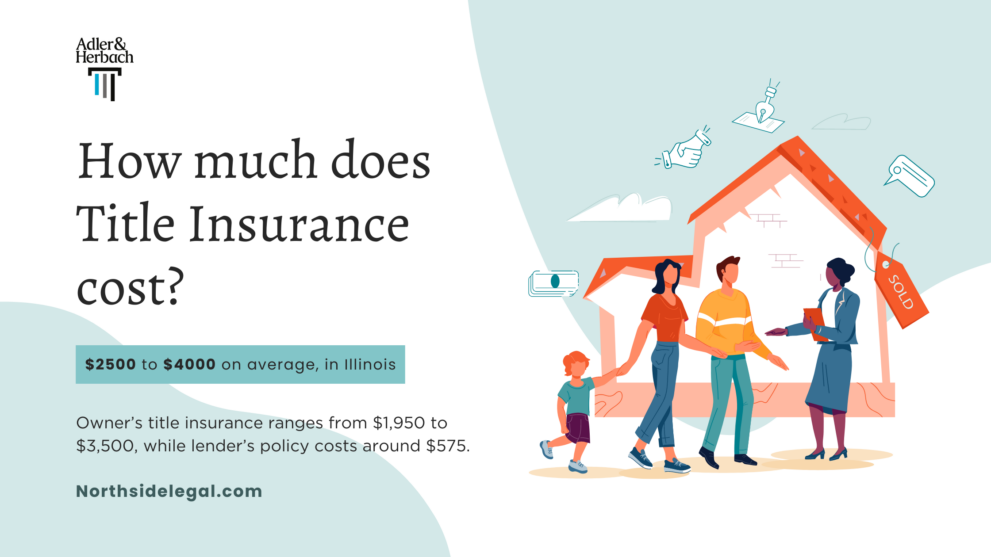

In Illinois, title insurance costs range between $1,950 and $3,500 for the owner’s title insurance and around $575 for the lender’s policy. Total costs, therefore, usually fall between $2,500 and $4,000. These costs can increase for more expensive properties. Title insurance premiums are regulated by the state’s Department of Insurance.

1. How much is the Owner’s Title Insurance cost?

- In Illinois, owner’s title insurance usually costs between $1,950 and $3,500 on average, depending on the home’s value and purchase price.

- The owner’s insurance premium increases incrementally based on these factors, typically by around $2 per $1,000 of value.

- For a $500,000 home, expect to pay around $2,750 for owner’s title insurance in Illinois.

The owner’s title policy covers the equity and interests of the homebuyer. It protects their ownership rights from title discrepancies.

2. How much is Lender’s Title Insurance cost?

- In Illinois, Lender’s title insurance usually costs around $575 when issued at the same time as the owner’s policy. It may be slightly higher if purchased separately.

- The lender’s policy amount equals the mortgage loan amount.

The lender’s policy (also called a loan policy) covers the financial interests of the mortgage lender. It protects their lien position in case of issues with the legal property title.

3. Total Title Insurance Costs

Accounting for both polices, total title insurance costs range from $2,500 to $4,000 on average in Illinois, depending on specifics of the transaction.

With both owner’s and lender’s premiums based on the home value and loan amount, total costs rise accordingly for more expensive properties.

While rates are not fixed in Illinois, title insurance premiums charged by different companies are regulated by the state Department of Insurance. So, pricing is generally more consistent than other states without these oversight regulations.

For Buyers

Safeguard your home purchase in Illinois. Our real estate attorneys can protect you from costly title issues. Call for a free consultation and secure your investment!

For Sellers

Avoid title-related problems when selling your home. Consult with our experienced real estate attorneys to navigate title insurance in Illinois and close with peace of mind.

Call now & Get a Free Consultation!

Special Offer: Mention this website and get a free consultation on your first service!

What Is Title Insurance?

Title insurance is a one-time fee paid by the buyer and/or seller when purchasing a new home, condo, or other real estate. It’s usually required by mortgage lenders as well. This insurance protects against any financial losses that may occur from defects in the legal title of the property.

Some common title defects include:

- Fraudulent deeds

- Mistakes in public records

- Undisclosed heirs

- Forgery

- Liens against the property

- Incorrect notary acknowledgments

- Issues with probate proceedings

- Boundary or survey disputes

The title insurance company will research records to identify defects before the sale closes. If they discover problems, they will take steps to fix them whenever possible. This prevents issues from derailing the sale.

Title insurance also provides ongoing protection for the policyholder if covered title disputes or claims arise in the future. The insurance company would cover the legal defense costs and financial losses up to the policy limits. This coverage lasts as long as the policyholder owns or has an interest in the property.

While not legally required, owning title insurance protects homeowner’s financial investment in their home against threats that can be extremely difficult and expensive to resolve on their own. Before paying hundreds of thousands of dollars for a property, buyers want the assurance that no one else has a claim on the title.

What Does Title Insurance Cover?

Title insurance covers financial losses arising from defects in the legal title of a property that affect ownership rights. This includes issues like:

- Financial loss due to title issues such as ownership claims, title disputes and unpaid property taxes

- Unknown liens or encumbrances on the property

- Errors in public records or deeds

- Fraud or forgery in the title documents

- Invalid deeds due to improper execution or delivery

- Missing heirs or undiscovered wills

It protects against covered title problems both before and after closing.

What Fees Are Included In Title Insurance Costs?

When reviewing your title insurance costs, here are some common fees that may be bundled into the total premiums:

- Title search fee – researching public records for any defects

- Owner’s Policy premium

- Loan Policy premium

- Endorsements like location coverage, inflation protection, etc.

- Commitment and Policy update fees

- Closing protection letter

- Government recording charges

- Tax and other certificates

- Overnight mail charge

- Wire fee

- Transfer tax

- Settlement fee

- Notary fee

- Email/electronic document fee

Learn more about how much does a title company charge in title fees

Because real estate deals are complex and costs can vary significantly between different properties, make sure you understand exactly what is covered in your quoted title insurance premiums versus any separate fees you may also be charged.

Scrutinize your Closing Disclosure paperwork to identify what costs are included with your title insurance policy versus extra add-on charges. This helps avoid surprises and ensures you know what you are paying for.

Who pays title insurance Cost?

The seller typically pays the owner’s title insurance policy premium. This is often negotiable when making an initial purchase offer. The homebuyer pays for the lender’s insurance policy as part of overall closing costs. By tradition in Illinois, the buyer and seller split the title insurance costs.

However, real estate transactions are always subject to negotiation. Creative buyers may be able to get sellers to cover more closing fees like the owner’s insurance premium. Savvy sellers can perhaps shift this cost back to buyers as part of the transaction. You may be able to save money by negotiating title insurance costs with the other party.

See our guide on how much are closing costs on a house for more details on what fees buyers and sellers commonly pay at closing.

Main Types of Title Insurance Policies in Illinois

There are two primary kinds of title insurance policies available in Illinois. Both are important protections for homeowners and lenders:

1. What is the Owner’s title insurance?

The owner’s title insurance policy is an optional form of insurance that covers the buyer’s interests in the new home. It protects against financial harm from any covered title defects affecting legal ownership of the property.

Benefits of optional owner’s insurance include:

- Financial Protection – Owners policy covers legal costs and losses from title disputes affecting ownership rights.

- Peace of Mind – Robust insurance lets you rest easy knowing your rights are protected.

- Long-Term Coverage – The owner’s policy shields you until you sell the property.

- Catch Issues Early – Title searches spot problems so they can be fixed before closing whenever possible.

- Avoid Hassles – Insurance company handles claims and legal battles so you don’t have to.

- Prudent Investment – One small premium protects your equity for as long as you own the home.

2. What is a lender’s title insurance?

The lender’s title insurance policy (or loan policy) is required by mortgage lenders when financing real estate purchases. This insurance protects the financial interests of the bank or lender providing funds to buy the home.

Key attributes of lender’s title insurance:

- Insures their lien position in case of title issues

- Covers losses up to the mortgage loan amount

- Reduces lender’s risk when issuing home loans

- Policy lasts until mortgage is paid off in full

While owner’s insurance is optional for buyers, lender’s insurance is mandatory any time you finance a property purchase.

Lender’s title insurance vs. Owner’s title insurance

While owner’s and lender’s policies work together to shield both parties, there are some key differences.

Here’s a table on that:

| Particulars | Lender’s Title Insurance | Owner’s Title Insurance |

|---|---|---|

| Purpose | Protects the lender’s investment in the property if a title defect is found | Protects the owner’s investment in the property if a title defect is found |

| Required? | Yes, usually required by the lender | Not by law, but recommended and typically required by the sale contract |

| Coverage duration | Coverage ends when the loan is paid off or refinanced | Coverage lasts as long as the owner owns the property |

| Coverage amount | Coverage is equal to the loan amount | Coverage is equal to the purchase price or property value |

| Cost | Paid for by the buyer | Typically paid for by the seller |

| Coverage for legal fees | Usually not covered | Sometimes covered |

| Coverage for property surveys | Covered with survey | Covered with survey |

| Claim filing process | Lender files the claim on behalf of the borrower | Owner files the claim |

| Claims payout | Paid to the lender to cover the outstanding loan balance | Paid to the owner for any losses suffered due to a title defect |

So in summary, the owner’s policy takes a broader view by protecting all your equity interests as the property owner.

Do You Need Title Insurance in Illinois?

Unlike lender’s title insurance mandated by banks, owner’s title insurance is not required by law, but strongly recommended to protect homeowners against threats that could lead to expensive legal battles or loss of property rights. For major investments like homes, title insurance brings invaluable peace of mind.

Where to buy Title insurance?

While you focus on finding the perfect home, title insurance decisions are mainly handled by:

- The seller’s attorney chooses the title company for purchase deals. They want an experienced provider to limit liability over title issues.

- Your lender likely has established relationships with certain title insurance companies. They may push you in that direction or offer discounts.

A. Who sells Title insurance?

Title insurance is sold by specialized real estate settlement companies and title insurers who conduct property title searches and handle the closing process. Attorney firms facilitate title insurance sales as well, as part of representing buyers and sellers in real estate transactions.

B. What is a Title insurance agent?

A title insurance agent is a representative of a title insurer who is licensed to sell title insurance policies, perform title searches, and handle real estate closings. Title agents have expertise in examining property titles and legal records to identify risks, clear defects, and facilitate smooth transactions.

How does title insurance work?

Title insurance companies research public records prior to closing to identify any defects impacting the legal title for the property. If any issues are found, the title insurer takes steps to clear the problems whenever possible.

After closing, the one-time policy premium paid by the homebuyer continues providing protection in case any covered title disputes or claims arise in the future.

This allows the policyholder to submit claims to the insurance company, which is obligated to cover financial losses and handle the legal defense based on the policy terms. Title insurance coverage remains in effect as long as the policyholder continues owning the property.

1. What is the purpose of Title insurance?

The purpose of title insurance is to protect real estate owners’ and lenders’ financial interests by providing coverage for losses arising from covered title defects impacting legal rights to the property. This risk transfer brings valuable peace of mind to homeowners and lenders.

2. Why do you need title insurance on a mortgage?

Title insurance is required by lenders in mortgage transactions to minimize their risk. It provides protection against undiscovered title defects, legal claims against the property, challenges to foreclosure, and helps manage risk in large loan portfolios. This insurance safeguards lenders from potential financial losses that may arise from these threats.

A. Undiscovered Title Defects

Even the most careful title search can miss subtle issues like fraud, forgery, faulty legal procedures or undiscovered liens that could emerge down the road. Title insurance protects lenders if such threats materialize.

B. Legal Claims Against Property

If a lawsuit or lien arises disputing the legal ownership of the collateral property, the lender’s rights are jeopardized too. Title insurance defends against such claims and protects their financial position.

C. Foreclosure Challenges

The lender risks enormous costs if their ability to foreclose and sell the property is challenged in court over title flaws. Title insurance shields lenders from these collection hurdles.

D. Large Loan Portfolios

Big lenders originate thousands of loans annually. Mandating insurance helps minimize overall portfolio risk cost-effectively versus extensive title reviews for each property.

In short, lender’s title insurance allows banks to loan money for home purchases while offloading major risks that could prevent them from seizing collateral or recouping unpaid debts in a worst case scenario. This drives an accessible mortgage market.

3. What is defective Title insurance?

Defective title insurance refers to cases when an insurer wrongfully denies a policyholder’s claim despite the title problem clearly falling under the policy’s coverage terms. This forces the homeowner to fight for compensation owed under the policy.

4. How to file a claim against Title insurance?

To file a title insurance claim, contact your insurer quickly after discovering a covered title defect. Provide documents supporting the problem and proof of ownership. Be ready to explain when the issue arose and how losses resulted.

5. How to get a copy of Title insurance policy?

Contact your title company for a copy of the final title insurance policy, or your closing lawyer, who can request it from underwriting files. Review coverage terms, exclusions, and claims procedures when you first receive the policy.

6. What are Title insurance endorsements?

Title insurance endorsements are optional add-ons that expand the scope of coverage provided by the base policy, for an additional premium cost. Common endorsements cover extended title search periods, inflation protection, location coverage for surveys, and enhanced protection specifically for lenders.

7. What is gap coverage Title insurance?

Gap coverage endorsements protect against losses arising between the title search date and the final property closing. This “gap” is when new liens or claims could arise. Gap coverage enhances protection.

8. How much Title insurance should I buy?

Experts recommend buying enough title insurance to cover the property’s full purchase price for owner’s policy, and the mortgage amount for lender’s policy. Higher coverage gives more comprehensive protection.

9. Title insurance premiums quote vs Loan estimate

The title insurance premium quote often differs from the estimates shown on initial loan estimates because the ultimate quote uses the most current data on the property’s value, sale price, and loan amount. Loan estimates may be based on older information.

Additionally, title quotes account for applicable endorsements and all final associated fees assessed at closing, some of which may not be captured accurately on the general loan estimate.

10. Why is a Title Search Required with a Mortgage?

Lenders mandate title searches to uncover risks like undisclosed liens before approving loans. This protects their collateral position. Title issues could prevent them from foreclosing and recouping unpaid debts.

How to Save on Title Insurance Costs?

While title insurance rates are relatively fixed across Illinois, here are some tips that can potentially lower your costs:

1. Can you shop for Title insurance?

The biggest opportunity to save money is getting quotes from multiple title insurance companies. Compare their premiums and fee structures side-by-side to see who offers the best value. Even a few hundred dollars in savings is worthwhile given the large expenses associated with real estate transactions.

For example, the law firm of Adler & Herbach works with a title company (United Settlement Services) that charges half the rate of most other providers on all seller title fees.

2. Seek out New Pricing Packages

Some title insurers are beginning to offer “all-in” pricing plans that bundle services together at a discounted rate compared to paying for each a la carte. See if any firms in your area provide these cost-saving packages.

3. Negotiate with the Seller

Since the seller traditionally covers the owner’s policy, ask them to shop for the best deal or even split the savings if they find a lower price. Pitch this as a win-win to help the transaction go smoothly.

4. Leverage Lender Relationships

Many lenders partner with certain title companies and offer closing cost credits or discounts to borrowers who use their preferred providers.

5. Purchase Simultaneous Policies

Most companies give a discounted rate when issuing owner’s and lender’s title insurance together in the same transaction. This is much cheaper than buying separately.

6. Research Insurer Financial Strength

Title claims are rare but do happen. Opting for a highly rated, financially strong insurer minimizes any hassle if you ever need to file a future claim.

7. Review Disclosures Closely

Scrutinize your Closing Disclosure and ask the title company to clarify any vague fees or confusing charges before closing the transaction.

How to Choose the Right Title Insurance Policy?

Choosing the optimal title insurance policy boils down to three main steps:

1. Compare Options from Multiple Companies

Gather rate quotes from several highly-rated title insurers. Compare based on premium costs, included services, endorsements offered, and customer service ratings. A few hours researching can save hundreds of dollars.

2. Review Policy Coverage Carefully

Read the actual policy terms to see what risks are covered versus excluded or limited. Make sure the core title threats you seek protection from are included and not disclaimed. Also confirm the dollar limit matches your property’s value.

3. Add Any Needed Endorsements

Consider supplemental endorsements to expand useful coverages like inflation protection, location coverage for surveying risks, extracellular risk coverage, and more. The right endorsements customize protection for your situation.

Leaning on an experienced real estate attorney can help identify the optimal title insurance company and policy mix for your specific situation and risk profile when buying or refinancing property. Don’t leave anything to chance.

Pay just one-half of the title fees

Mention this website (Northsidelegal.com).

1. Pay just 50% of your Title fees. Keep the other 50% in your pocket

2. Get a consultation from our real estate attorneys at zero cost.

Do you need Title insurance when refinancing?

Many homeowners refinance their mortgages to benefit from better interest rates or tap home equity. While refinances involve less risk and cost than purchases, title insurance remains an important safeguard.

Here are key considerations around title insurance when refinancing real estate:

- The lender will require you to purchase a new lender’s policy to protect their interests.

- You can likely secure a discounted “reissue rate” (as low as $250) on the lender side since title was recently searched. This results in cost savings versus a purchase transaction.

- Owners often keep their existing owner’s policy in force without buying new insurance.

Conclusion

While optional, title insurance is a prudent purchase to protect property owners and lenders during real estate transactions. Shop multiple insurers to minimize premium costs, scrutinize policy coverage terms, and work with experienced real estate professionals.