Selling your home is a big decision that involves many factors and considerations. One of the most important and challenging ones is how to price your house for sale.

How To Price A House For Sale?

To price a home for sale, use online tools to estimate value, perform a comparative market analysis, and examine other listings. Choose savvy pricing tactics, understand the current real estate market, learn when to adjust your asking price and add value by staging and improving your home.

Step 1: Use online home value estimation tools

Use AVM’s, Zillow Zestimate, Redfin’s price estimate and Federal housing finance agency’s home price calculator.

Step 2: Do Comparative market analysis (CMA)

Learn what are comps and how to conduct a CMA. Know the difference between a real estate agent created CMAs and independent appraisals.

Step 3: Explore sold, pending and withdrawn listings

Learn from other seller’s mistakes and avoid making them yourself.

Step 4: Use proven pricing tactics

Learn Sale to list ratio, psychology driven ’99’ strategy and price banding to stand out form the crowd.

Step 5: Master the real estate market

Learn what are buyer’s market, seller’s market and neutral market. Know what type of market you’re in and time your home sale perfectly.

Step 6: Learn price adjustment strategies

Learn when it’s time to adjust the price of your house, pricing contingency plan and factor in closing costs.

Step 7: Enhance the price of your house

Declutter and depersonalize your home. Stage, decorate, clean and repair your home to enhance its value.

What is my house worth?

Your house value depends on many factors. These include location, property type, square footage, number of bedrooms/bathrooms, age and condition of the home, materials and finishes, special features, and land value. For an accurate assessment, consult a local real estate professional who can prepare a comparative market analysis.

Pricing your home right can make or break your home sale success. It can determine how fast you sell your home, how much profit you make, and how satisfied you are with the outcome.

- How do you find the optimal price for your home in a complex and dynamic market?

- How do you avoid overpricing or underpricing your house and losing money?

- How do you maximize the value of selling by owner (FSBO) and save thousands of dollars in commissions?

Step 1: Use Online Home Value Estimation Tools

While nothing can replace an in-person appraisal from a professional (yet), several online programs have been developed as tools that can be used to augment decisions and provide more information.

1. Automated Valuation Models (AVMs)

Automated Valuation Models (AVMs) are programs that use algorithms to estimate the market value of a property based on various data inputs. AVMs are used by lenders, appraisers, investors, and real estate professionals to evaluate properties quickly and efficiently.

- AVMs can provide you with a ballpark figure of your own home value. Yet they cannot replace a professional appraisal or a comparative market analysis, because,

- AVMs may not capture all the factors that affect a property’s value, such as its condition, features, upgrades, location and local market demand.

- AVMs can not account for the subtleties of human emotion and preferences that influence buyers and sellers.

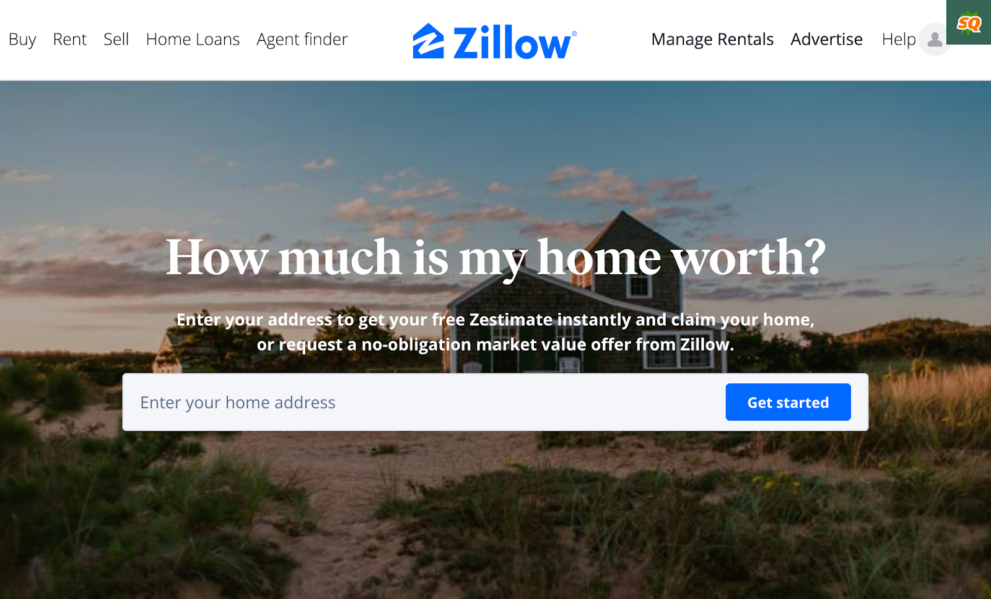

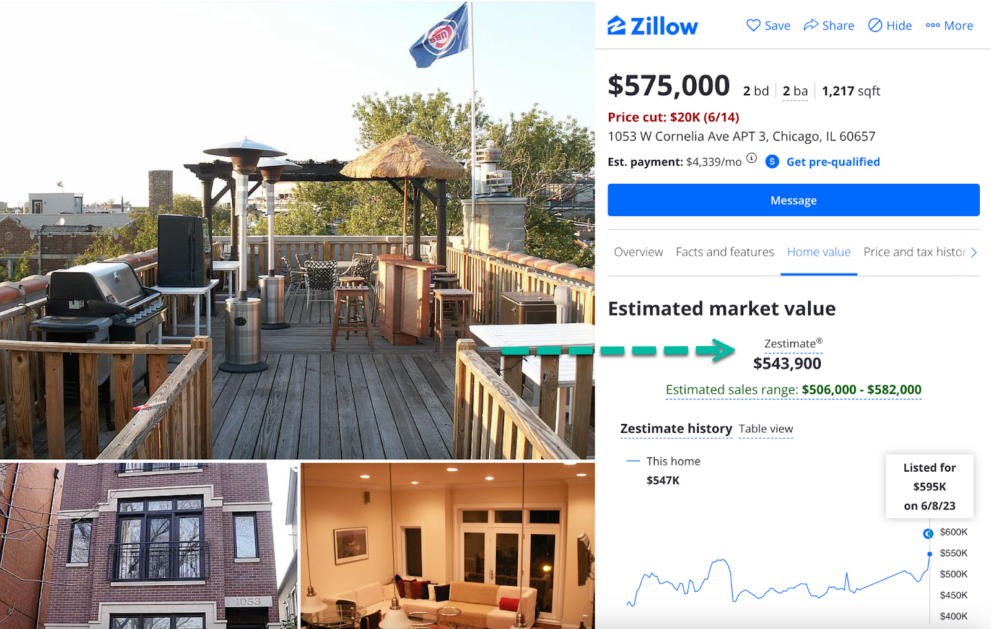

2. Zillow’s Zestimate

Zillow’s Zestimate is one of the most widely used online home value estimation tools. It gives an estimated market value for your individual home, computed daily based on millions of public and user-submitted data points.

You can find your Zestimate by searching your address on Zillow’s website.

From there, claim your home and review your home facts to ensure they’re updated. Adding details to your listing can influence your Zestimate and show potential buyers the most accurate value for your home.

- According to Zillow, the median error rate for on-market homes is 1.9%, which means half of the Zestimates are within 1.9% of the final sale price, while half are off by more than 1.9%.

- For off-market homes, the median error rate is 7.5%.

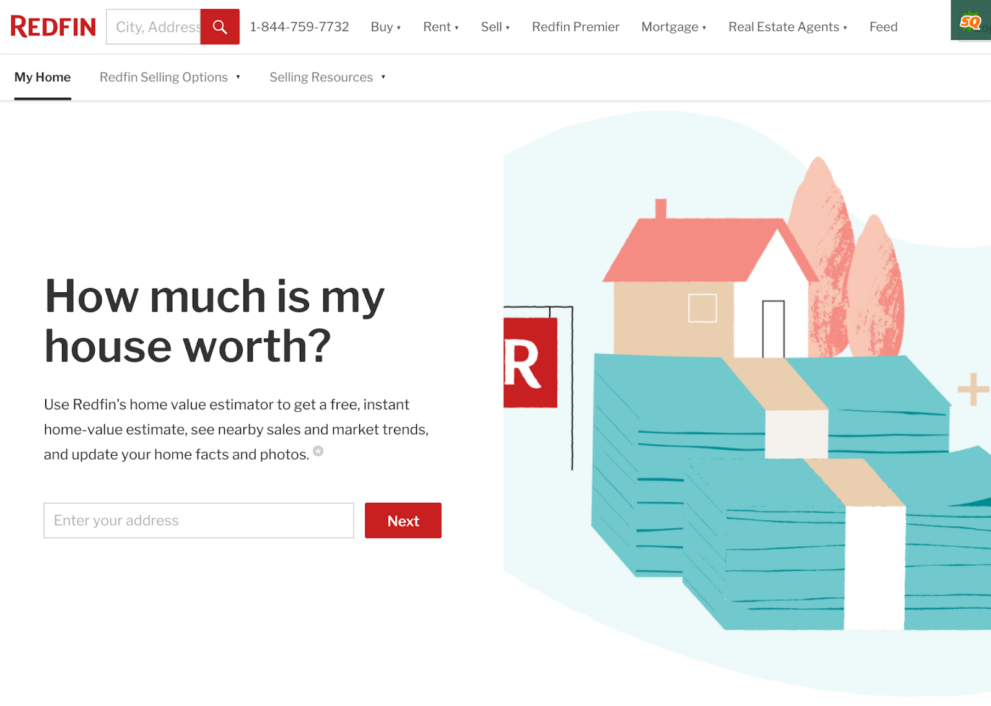

3. Redfin’s Price Estimate

Redfin’s Price Estimate is another popular online home value estimation tool. It is also an automated valuation model (AVM) that uses a proprietary algorithm to estimate a home’s current market value based on recent sales data from multiple sources such as MLSs (multiple listing services), county records, tax assessments and homeowner inputs.

- You can find your Price Estimate by searching your address on Redfin’s website or app. You can also edit your home facts to improve the estimate’s accuracy.

- Redfin claims its Price Estimate is more accurate than Zillow’s Zestimate because it has access to more data sources and updates them more frequently.

- According to Redfin, its median error rate for on-market homes is 2.1% as of June 14, 2023. In comparison, its median error rate for off-market homes is 6.66%.

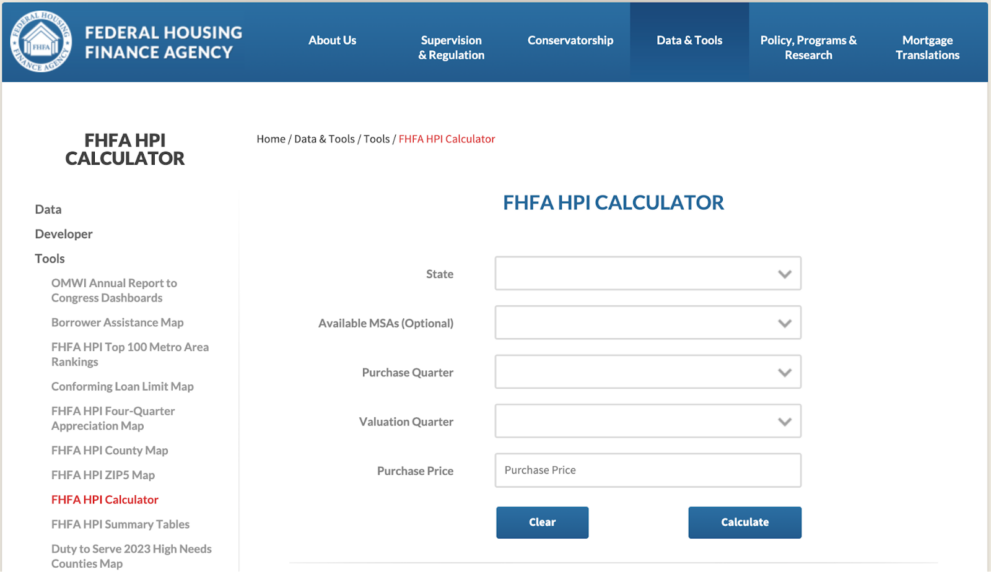

4. The Federal Housing Finance Agency’s Home Price Calculator

The Federal Housing Finance Agency’s (FHFA) Home Price Calculator is an online tool that uses a scientific method called “repeat sales” to measure how much home prices have changed over time in a given area.

It compares the sales prices of similar homes that have sold more than once in a given area. It then calculates how much these homes have appreciated or depreciated in value over time. After that, it applies this rate of change to your home’s value based on its purchase price and date.

It can also help you adjust your home price based on inflation or deflation using the Consumer Price Index (CPI).

This calculator has some limitations too. It only covers homes that:

- Have been financed by conventional mortgages bought or guaranteed by Fannie Mae or Freddie Mac;

- Have sold more than once in a given area over a period of time;

- Are similar in size, features, condition and location. So it doesn’t account for any improvements that may affect your home’s price.

Compare it with other sources and methods for estimating your home price.

For Buyers

Get the best deal! Stay informed on pricing strategies for your dream home with our expert attorney services.

For Sellers

Price your home to sell quickly! We offer legal services to FSBO sellers at the same flat rate as agent-represented sellers.

Call now & Get a Free Consultation!

Special Offer: Mention this website and get a free consultation on your first service!

Step 2: Comparative Market Analysis (CMA)

A CMA is a detailed report comparing your home to similar properties recently sold in your area. These properties are called comparables, or comps.

CMA Unveiled: From Definition to Action

A CMA typically consists of 3 main parts:

- An overview of your home

- Includes basic information such as the address, property type, size, age, condition and features of your home.

- A list of comps

- Contains similar information for each comp: the original list price, final sale price and number of days on the market.

- An adjustment grid

- A comparison of your home to each comp, where you can adjust for any differences that impact the value.

See a sample CMA from CloudAgentSuite.

Follow these steps to conduct a CMA:

- Define your criteria for selecting comps.

- Look for properties that are similar to yours in terms of size, features, condition, location and age.

- Look for properties within a 1-mile radius of your home that have sold within the last 3 months.

- Search for comps.

- Use Hooquest, FitSmallBusiness and Learnprop to learn more about how and where to search for comps.

- Search Zillow or Redfin.

- Use databases like MLSs or county records to access more detailed and accurate information.

- Select at least 3 to 5 properties most comparable to your home.

- Avoid using properties that are outliers, such as foreclosures, short sales, distressed sales, or unusually high or low priced sales.

- Compare your home to each comp and make adjustments for any differences.

- Start with the sale price of each comp and add or subtract value based on how your home differs from it.

- For example,

- If your home has one more bedroom than a comp, add value to your home.

- If your home has one less bathroom than a comp, subtract value from your home.

- Use a percentage or a dollar amount per unit to make the adjustments, depending on the type of difference.

- Calculate the adjusted sale price of each comp and find the average.

- The average of the adjusted sale prices is your estimated market value based on the CMA.

Download a step by step CMA preparation guide here.

Real Estate Agent-Created CMAs vs. Independent Appraisals

| Real Estate Agent-Created CMAs | Independent Appraisals | |

| Objectivity | May not be as objective or accurate due to potential incentives to inflate or deflate the value of your home. | More reliable and authoritative as it is done by a licensed appraiser who follows standardized guidelines and procedures. |

| Purpose | Is often used by real estate agents to attract potential clients and provide a general idea of home value. | Usually required by lenders for mortgage applications or refinancing, or ordered by buyers during negotiations. |

| Methodology | Agents may use different methods or sources for conducting CMAs compared to appraisers. | Follows more data-driven analysis using standardized guidelines and procedures. |

| Cost & Time | Typically provided free of charge by real estate agents as part of their services. | Can cost anywhere from $300 to $500+ and may take several days or weeks to complete depending on the appraiser’s availability and workload. |

| Credibility | Less credible compared to independent appraisals due to potential biases and subjective elements. | Provides a more accurate and credible valuation of your home based on impartial expertise and comprehensive data analysis. |

Weigh the pros and cons of each option before deciding which one to use for pricing your house for sale.

Step 3: Explore Sold, Pending and Withdrawn Listings

1. Sold Listings

Sold listings are properties successfully sold and closed in your area.

- They show you what buyers are willing and able to pay for similar properties in the current market.

- They are the primary source of data for CMAs and appraisals.

To use sold listings effectively, you should look at the following aspects:

- The original list price vs. the final sale price.

- Shows how much sellers had to negotiate or compromise on their asking price to close the deal;

- How realistic or unrealistic their initial expectations were.

- The number of days on the market (DOM).

- Shows how long it took for sellers to find buyers and sell their properties;

- How popular or desirable their properties were in the market;

- The current level of demand for properties in your area.

- The price per square foot (PPSF).

- Shows how much value buyers assign to each square foot of a property;

- How efficient the properties were in terms of space utilization.

Learn from other sellers’ experiences and avoid repeating the same mistakes.

Benchmark your home against other sold properties and determine a reasonable price range based on what buyers have paid for similar homes. Pay attention to whether there is a minimum square footage in your area that satisfies buyers’ requirements, as well as the point at which the value of additional square footage provides diminishing returns.

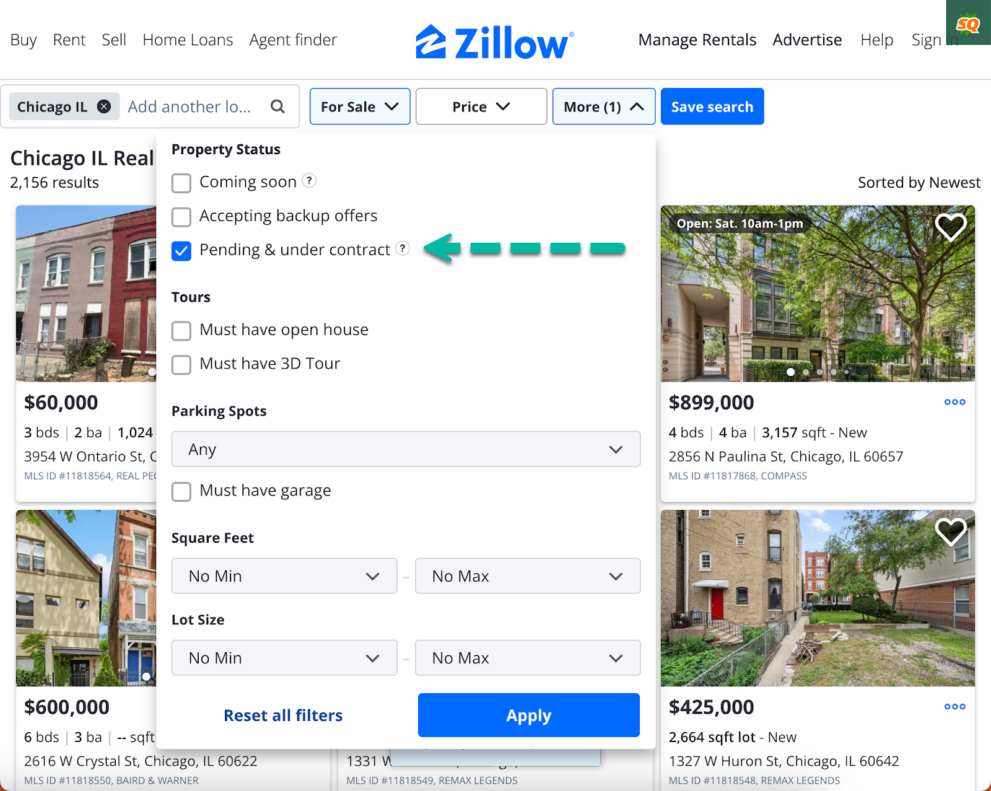

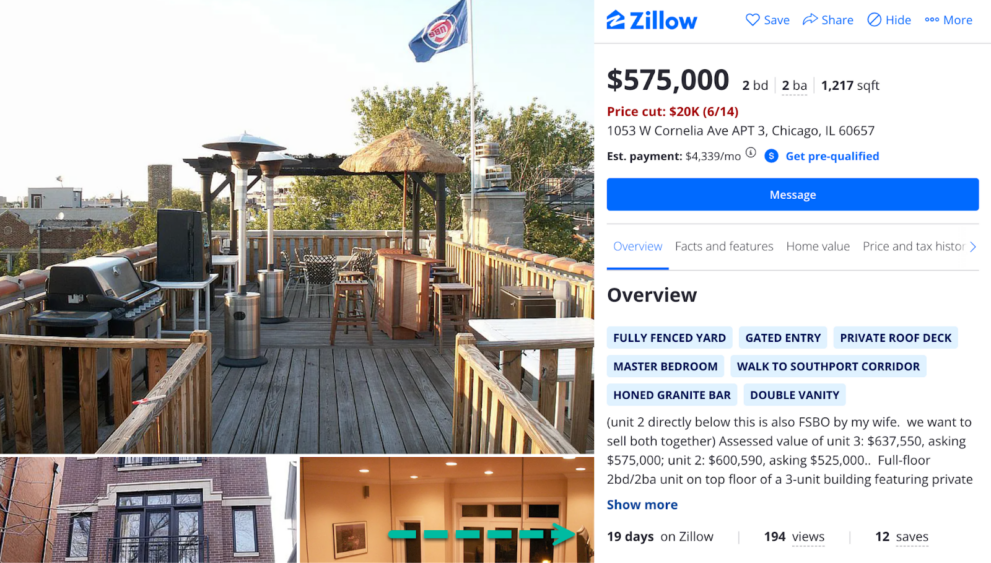

2. Pending Sales

Pending sales are properties that have accepted offers but have not closed, also known as under-contract or contingent listings.

Peek into the market’s future and anticipate what kind of offers you can expect using Pending sales listings. You can easily gauge how fast properties are moving and how attractively they are priced.

A. List price vs. the offer price

This shows

- How much do the buyers negotiate on their offers compared to the asking price?

- How aggressive buyers are in the market.

The offer price information is not publicly available and can only be obtained from the seller or the agent involved in the deal.

You can contact them and ask them politely and discreetly if they are willing to share this information with you.

You can also use Zillow’s Zestimate to see the estimates for the offer price.

- Filter the list to show only pending listings.

- Open the listings one by one.

- Compare Zillow’s Zestimate with the list price.

B. Number of days on the market (DOM)

This shows

- How long did it take to go under contract from the listing date?

- How fast properties are moving and how attractive they are priced in your market.

- A low number of DOM indicates a seller’s market where properties sell quickly and at or above the asking price.

- A high number of DOM indicates a buyer’s market where properties sell slowly and below the asking price.

In Zillow,

- After filtering pending listings,

- Open each listing.

- Below the property description in the overview section, you can find the DOM.

3. Withdrawn Listings

Withdrawn listings are properties that sellers took off the market before they sold. They are also known as expired, canceled, or terminated listings.

- They show you what buyers are not willing or able to pay for similar properties in the market.

- They are also a warning sign of potential pitfalls and problems that can derail a successful home sale.

To use withdrawn listings effectively, you should look at the following aspects:

- The list price vs. the market value.

- Shows how much sellers overpriced or underpriced their properties compared to the fair market value;

- How unrealistic or uninformed their expectations were.

- The number of price reductions or changes.

- Shows how much sellers had to lower or adjust their asking price to attract buyers and sell their properties;

- How desperate or flexible they were in the market.

- The feedback or comments from buyers or agents.

- Shows what buyers liked or disliked about the properties and why they did not buy them;

- What improvements or changes sellers could have made to sell their properties.

Learn from other sellers’ mistakes and avoid making them yourself.

Identifying and addressing any flaws or weaknesses in your home will also make it more appealing and attractive to buyers.

Step 4: Proven Pricing Tactics

Asking price is the amount of money you want a buyer to pay for your home.

It determines

- How quickly your home will sell;

- How much profit you stand to make; and

- How satisfied you will be with the outcome.

But how do you set an irresistible asking price for your home?

How do you balance your financial goals and emotional attachments with market realities and buyer expectations?

How do you stand out from the competition and attract more buyers to your home?

There are some proven tactics based on psychological principles and market strategies that can help you create a positive impression and a sense of urgency among buyers.

1. Pricing Strategy Based on Sale-to-List Ratio

The list price is the money you ask for your home when you list it on the market. The selling price is the money you actually receive when you sell it. The difference between the list price and the selling price is called the sale-to-list ratio.

The sale-to-list ratio measures how close you get to your asking price when you sell your home. It is calculated by dividing the selling price by the list price and multiplying by 100%.

For example, if your list price is $300,000 and your selling price is $285,000, your sale-to-list ratio is 95% ($285,000 / $300,000 x 100%).

The sale-to-list ratio can vary depending on the property characteristics, negotiation skills and motivation levels of both parties.

Why does this matter?

- A high sale-to-list ratio means you got close to or above your asking price when selling your home, maximized your profit and achieved your financial goals.

- A low sale-to-list ratio means you got far below your asking price when selling your home; may have taken longer than you would have liked to come to terms on an offer; likely left money on the table; and compromised your financial goals.

So, as a seller, aim for a high sale-to-list ratio when pricing your house for sale.

- Set a realistic, competitive and attractive asking price to buyers.

- Be prepared to negotiate and adjust your asking price to close the deal if necessary.

2. The ’99’ Strategy: Psychology-Driven Pricing for Quick Sales

In the ’99’ strategy, you price your home slightly below a round number, such as $299,500 instead of $300,000. This tactic is based on a psychological phenomenon called the left-digit effect, which states that people tend to focus more on the leftmost digit of a price, creating a perception that the total number is lower than it actually is.

The ’99’ strategy can help you achieve two goals as a seller.

- Attract more buyers to your home by making it appear more affordable and appealing.

- Sell your home quickly by creating a sense of urgency and scarcity among buyers.

Buyers will think your home is a bargain or attractively priced, which they must act on quickly before someone else snatches it.

But it also has some drawbacks, so use the ‘99’ strategy sparingly.

- Buyers may become suspicious or cynical if they see too many homes priced with the ’99’ strategy or odd numbers that don’t make sense, such as $299,997 or $299,999.99. They may also associate your home with lower-quality or discount products that use the same pricing tactic.

- Avoid using it if your home is in a luxury or high-end segment where buyers may expect more sophistication and precision in pricing.

Feel free to use the ‘99’ strategy if your home value is close to a round number and if your market is competitive and fast-moving.

3. Price Banding: Stand Out in the Crowd

With the price banding technique, price your home within a specific band that matches the search criteria of most buyers in your market. It’s based on the principle of supply and demand, which states that the average price of a product depends on how much of it is available and how much people want.

Price banding can help you achieve two goals as a seller.

- Visibility and exposure of your home by making it appear in more online search listings.

- Most buyers use filters or brackets to narrow their search results by price range, such as $250,000-$300,000 or $300,000-$350,000.

- Suppose you price your home within these popular bands. In that case, you can reach more potential buyers and generate more interest and inquiries for your home.

- Make your home look like a better option than similar homes in the same band.

- Buyers will compare your home to others in the same band and perceive it as more desirable based on its features, condition, location, or other factors.

But price banding has some drawbacks.

- Limits your profit margin and negotiation power as a seller.

- If you price your home too low within a band, you may leave money on the table and lose out on potential profit.

- If you price your home too high within a band, you may scare away buyers and lose out on potential offers.

- It will backfire if you use it inconsistently, pricing your home as an outlier.

- Buyers may become confused if they see homes priced with different bands that don’t match their search criteria.

Research your market and find the most popular price bands for similar homes in your area. Consider your home features and decide where to position it within a band to maximize its appeal.

Step 5: Master the Market

The real estate market is a complex and dynamic system that changes constantly based on various factors. So pricing your house for sale isn’t an isolated event.

You need to anticipate how the market changes and how it will affect your home-selling prospects, then adapt and adjust your pricing strategy to match the market expectations.

Let me share some essential insights and tips based on market analysis and research so that you can identify and interpret the market signals that matter.

1. The Market Spectrum: Buyer’s, Seller’s and Neutral Markets Decoded

Depending on the balance between the supply and demand of homes in your area, the market can be classified into 3 types:

Buyer’s Market

A buyer’s market is where the supply of homes exceeds buyers’ demand, i.e. more homes are for sale than buyers who want to buy them.

- This gives buyers more choices and more bargaining power.

- As a result, prices tend to go down, homes stay on the market longer, and sellers make more concessions or incentives to attract buyers.

Seller’s Market (Hot Market)

A seller’s market is where buyers’ demand exceeds the supply of homes, i.e. more buyers want to buy homes than there are homes for sale.

- This gives sellers more leverage and negotiating power.

- As a result, prices tend to go up, homes sell faster, and buyers make more offers or compromises to secure homes.

Neutral Market

When the supply of homes and buyers’ demand is balanced, it’s generally called a neutral market. It means there are enough homes for sale and enough buyers to buy them.

- This gives sellers and buyers an even playing field to negotiate a deal.

- As a result, prices tend to stay stable, homes sell within a reasonable time frame, and both parties tend to make reasonable demands or concessions.

Why does this matter?

If you are in a buyer’s market, price your home lower than its fair market value to attract more buyers and compete with other sellers.

- Be flexible and willing to offer incentives to close the deal.

If you are in a seller’s market, price your home higher than its fair market value to take advantage of the high demand and low supply.

- Be selective and confident in rejecting lowball offers and unreasonable requests.

If you are in a neutral market, price your home at its fair market value to reflect its true worth to buyers and sellers.

- Be cooperative in negotiating and reaching a win-win agreement.

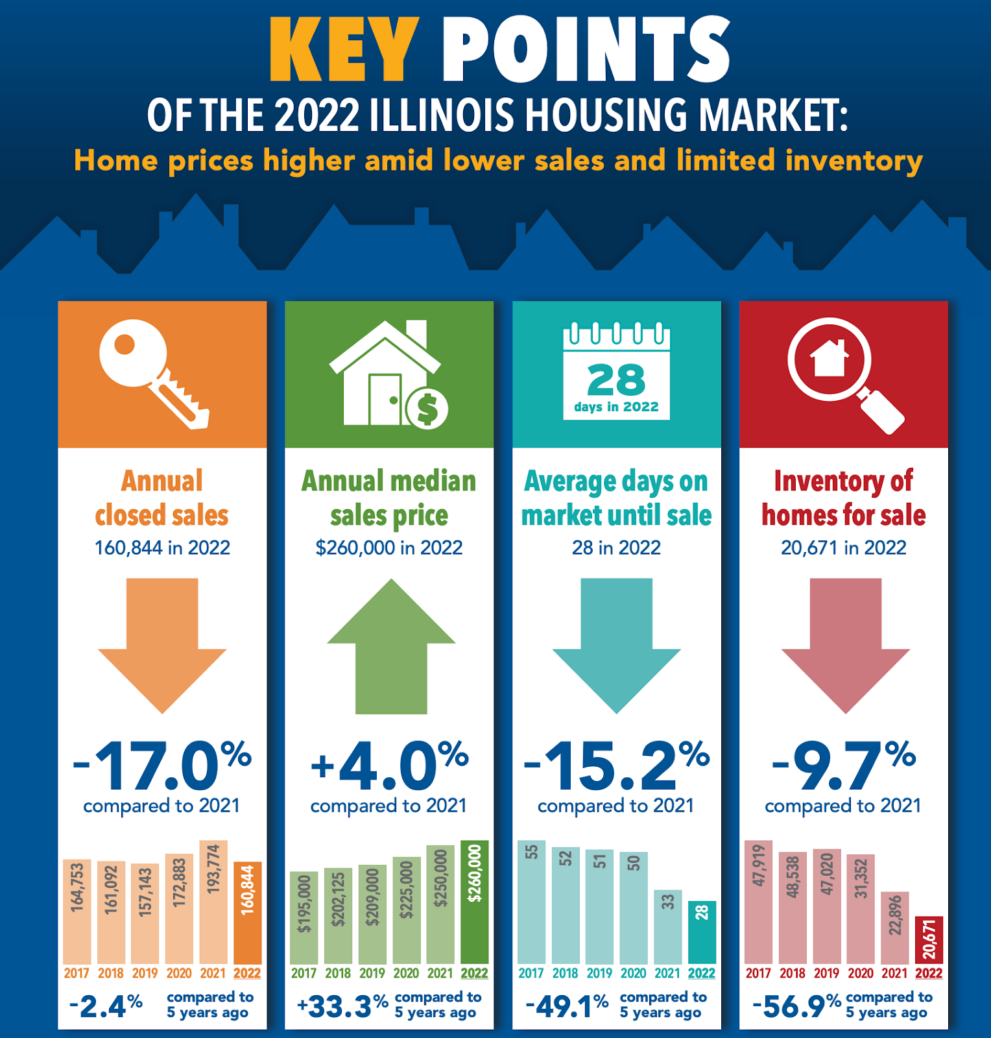

How do you know what type of market you are in?

Some of the most common and valuable indicators are:

Inventory or Absorption Rate:

- This is the number of months it would take to sell all the homes on the market at the current sales pace.

- It’s calculated by the formula (No. of homes for sale monthly sales).

- A low inventory rate (less than 4 months) indicates a seller’s market.

- A high inventory rate (over 6 months) suggests a buyer’s market.

- A balanced inventory rate (4 to 6 months) indicates a neutral market.

Median Sale Price:

- This is the midpoint of all the sale prices of homes sold in your area. It is not affected by outliers or extremes.

- A rising median sale price indicates a seller’s market.

- A falling median sale price suggests a buyer’s market.

- A stable median sale price indicates a neutral market.

List-to-Sales Ratio:

- This is the final sale price percentage to the original list price of homes sold in your area. (Final sale price original list price *100 )

- A high list-to-sale ratio (>= 100%) indicates a seller’s market.

- A low list-to-sale ratio (< 95%) suggests a buyer’s market.

- A moderate list-to-sale ratio (95% to 100%) indicates a neutral market.

You can learn more about the latest value of all these 3 indicators from IllinoisRealtors, Illinois.gov, National association of realtors.

2. Timing Your Home Sale Perfectly

Seasonality refers to the fluctuations in real estate market activity and performance throughout the year due to seasonal factors such as weather, holidays, school schedules and consumer behavior.

It affects the supply and demand of homes in your area, which in turn affects the price of your home.

Know the best time to sell your home, then plan and schedule your home sale accordingly to take advantage of peak seasons.

When is the best time to sell your home?

Typically, the best time to sell your home is in spring or summer (although it can vary based on your location, property type, target market and personal goals).

Spring and summer are the seasons when most buyers are active in the market. They usually look for new homes before the school year starts or winter sets in. They are also more willing to pay higher prices and make faster decisions.

When is the worst time to sell your home?

Typically, the worst time to sell your home is in fall or winter. These are the seasons when most buyers are unmotivated in the market.

They are busy with holidays, family gatherings, or work obligations. They are also more reluctant to pay higher prices and make faster decisions.

Keep in mind, though, these are generalizations and not universal. There are exceptions.

For example,

- Some markets may have different peak seasons due to their demographics.

- Depending on their features, some properties may have additional appeal.

- Certain buyers may have different preferences based on their lifestyle.

So look at historical trends for your area and property type from IllinoisRealtors.org, NoradaRealEstateInvestments, 2023 May Forecasts by Illinois Realtors and National Association of Realtors if you have the luxury of choosing when you want to list your house for sale.

3. Neighborhood Focus

Neighborhood focus is the influence of your neighborhood or local area on your home value and demand. It affects the desirability and attractiveness of your home to buyers.

As a seller, you must highlight and emphasize the positive aspects of your neighborhood or local area and address and mitigate the negative aspects of your community or local area.

Which Aspects of Your Neighborhood Affect the Price of Your Home?

Location and Accessibility

How convenient and easy it is to get to and from your neighborhood depends on the proximity and availability of transportation, including roads, highways, airports, public transit, etc.

- Buyers prefer neighborhoods close to or well-connected to work, school, shopping, entertainment, etc.

Amenities and Services

How comfortable and enjoyable your local area is includes factors such as the quality and availability of utilities, schools, health care, recreation, parks, restaurants, shops, etc.

- Buyers usually prefer areas with abundant amenities and services that suit their needs and preferences.

Safety and Security

How safe and secure it is to live in your neighborhood includes factors such as crime rate, police presence, fire protection, emergency response, etc.

- Buyers usually prefer neighborhoods with low crime and adequate safety and security measures.

Character and culture

How unique and appealing it is to live in your local area includes factors such as history, architecture, diversity, community, vibe, etc.

- Buyers usually prefer areas with distinctive or attractive characters and cultures matching their personalities and lifestyle.

To pin down such aspects within the Chicago area, do a hyperlocal analysis with Chicago.gov, or go macro with an analysis of the entire State of Illinois at Illinoisrealtors.org. You can also look into migration trends from Redfin.

Step 6: Price Adjustments

As a seller, it would be wise to

- Stay agile and be flexible in a fluid market.

- Track and measure the performance and results of your pricing strategy.

- Spot and analyze the indicators that tell you if your pricing strategy is working.

- Adjust your pricing strategy to match the market realities.

Let me share some guidelines based on market data and feedback analysis to help you decide when and how to adjust your price.

1. When Is It Time to Adjust the Price?

Adjusting the price too soon or too often can make you look desperate or unprofessional and hurt your credibility. Doing it too late or too seldom can cause you to miss out on opportunities and prolong your home-selling process.

When Is It Time To Adjust The Price Of Your House For Sale?

Though it depends on many factors, such as your market conditions, home value, pricing strategy, goals, and feedback from buyers, there are some signals that can help you determine if you’ve priced your house correctly or if you need to adjust it.

Some of them are:

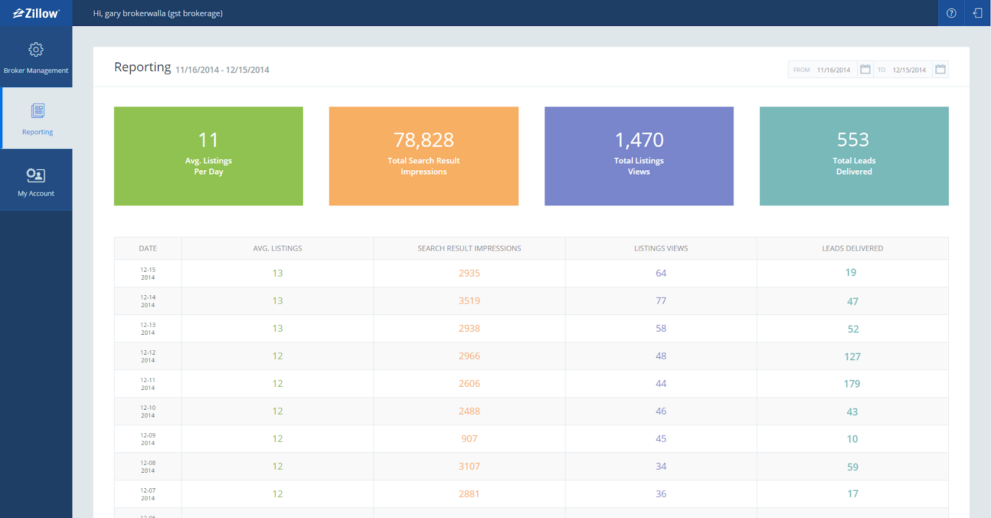

Number of Views or Inquiries:

- How many people have seen or contacted you about your home, both online and offline, is a measure of how much exposure and interest your home has generated in the market.

Number of Showings or Visits:

- How many people have come to tour your home in person is a measure of the demand and desire your home has created in the market.

Number of Offers or Bids:

- How many people have made formal or informal proposals to buy your home is a measure of how much value and urgency your home has established in the market.

Many inquiries, showings, and/or offers indicate that your price is attractive and your home has a good chance of selling quickly and profitably.

Too few views, showings, and/or offers show that your price is unrealistic or not competitive enough, and your home has a low probability of selling.

You can submit your house listing to Zillow. Once listed, you can check the statistics to know your listing views over time. You can get the inventories or listings data from Zillow research data.

Some of the guidelines and suggestions for deciding if you need to adjust your price are:

- Are you getting a high number of inquiries but a low number of showings?

- Your home is attracting attention but requires more action.

- Buyers are interested in your home but need more to come and see it in person.

- A slight price reduction could entice them to take the next step and visit your home.

- Do you have a high number of showings but a low number of offers?

- Your home is generating demand but needs more desire.

- Buyers like your home but need more to make an offer or a bid.

- A moderate price reduction can persuade them to take the final step and buy your home.

- Have a low number of views, visits and offers?

- Your home could be more appealing and competitive in the market.

- Buyers are not interested in your home at all.

- A significant price reduction can make your home more visible, increase competitiveness in the market and attract more buyers to your home.

2. Pricing Contingency Plan

A pricing contingency plan outlines how you will react to different scenarios affecting your pricing strategy. It can help you respond well when faced with challenges or opportunities in the market.

2 common scenarios that affect your pricing strategy are:

Change in Market Conditions

- Any shift or movement in the supply and demand of homes in your area can affect your home value and demand.

- For example,

- A sudden increase or decrease in the number of homes for sale or buyers looking for homes

- A change in interest rates or mortgage availability

- A change in the economic outlook or consumer confidence

Change in the Competition

- Changes or actions by other sellers or buyers in your market can affect your home’s value and demand.

- For example,

- New listings, market conditions, your home’s value, your pricing strategy, your goals and feedback received.

Some Guidelines and Suggestions to Adjust Your Price:

- If you have a high number of offers, but they’re below your asking price: Your home is creating value and urgency but is not desirable enough to justify your asking price.

- A slight price increase may signal to buyers that your home is worth more and increase chances of selling your home at a higher price.

- If feedback from buyers or agents is negative regarding some of your home’s features, condition and location, it will affect the desirability of your home and lower the demand for your home.

- If the appraised value or inspection results are worse than expected, the validity of your home’s value will be affected and cause buyers to renegotiate or back out of the deal.

- If you have many offers or bids at or above your asking price, your home is priced right, and you have achieved your pricing goal.

- You can accept the best offer or negotiate for a better deal.

How Do You Craft a Pricing Contingency Plan for These Scenarios?

- Think about what you are willing to compromise on when selling your home. Decide on a minimum acceptable price.

- Research and analyze your area’s market conditions, trends and property types.

- Identify the strengths and weaknesses of your home and how they compare to other homes in your market. Find the most critical concerns buyers have and how you can address them.

- Prepare and implement a range of possible actions or solutions for such concerns. Have a list of possible steps if things go differently than expected.

Possible Actions:

- Adjusting your price upward or downward depending on market conditions, feedback, appraisal, or inspection results.

- Offering incentives or concessions to buyers, such as paying for closing costs, repairs, warranties, etc.

- Making improvements or changes to your home, such as staging, decluttering, painting and landscaping.

- Changing your marketing strategy or tactics, such as updating your listing, adding more photos or videos, and creating a virtual tour.

- Expanding or narrowing your target market, such as reaching out to more buyers or agents and focusing on a specific niche.

- Waiting for a better time or opportunity to sell quickly, such as a different season, market cycle, or buyer profile.

Monitor and measure the outcomes of each action you take. Be flexible and adaptable to change based on the feedback and data that you receive.

Selling your home as a For Sale By Owner (FSBO) can save you money on agent commissions.

When selling a house by owner, it’s important to have the right paperwork in place.

3. Factor in Closing Costs

Pricing your house for sale also includes accounting for all the expenses and fees you must pay when you sell your home. These expenses are called closing costs.

Closing costs are the costs of transferring property ownership from one party to another. They include taxes and fees for the title company, the escrow company, the lender, the appraiser, the inspector, the attorney, the agent, etc.

Call now & Get a Free Consultation!

Special Offer: Mention this website (Northsidelegal.com) and get a free consultation on your first Real estate attorney service!

As a seller, be aware of typical closing costs for sellers in your area and how much they are. Factor these costs into your asking price and the profit margin. Negotiate and allocate these costs with the buyer as part of the deal.

Step 7: Enhance the Price of Your House

Some of the most simple and effective strategies are:

1. Decluttering and Depersonalizing Your Home.

- Remove any unnecessary belongings from your home that give a crowded, messy, or chaotic look.

- Remove personal and sentimental items that make it look too specific, customized and unique.

Decluttering will

- Create more space and light in your home.

- Make the home look more clean and organized.

Depersonalizing will

- Create a neutral and blank canvas in your home that can appeal to a broader range of buyers and allow them to imagine themselves living in your home.

2. Staging and Decorating Your Home.

- Arrange furniture, accessories, artwork and plants to make it look more stylish, cozy and appealing.

- Apply colors, textures, patterns and lighting to make it look warm, bright, and inviting.

Staging will highlight your home’s best features and qualities to make it look more attractive and desirable. Decorating will create a positive and pleasant atmosphere in your home that can influence the emotions of buyers.

3. Cleaning and Repairing Your Home.

- Remove any dirt, dust, stains and odors from your home that can make it look dirty or unpleasant.

- Fix any damages, defects, or malfunctions in your home that may make it look faulty or unsafe.

Cleaning will improve the condition of your home and make it look fresh. Repairing will avoid potential issues during the inspection and appraisal processes.

Use these methods to boost your home appeal and enhance your home value before you list it on the market. Maintain these methods throughout your home-selling process until you close the deal.

Learn how long does a home appraisal take and what documents to give to an appraiser.

The Bottom Line

Pricing your house for sale can be done correctly if you follow the proper steps and use the right tools.

- Estimate your home value using online tools like Zillow’s Zestimate, Redfin’s Price Estimate or (FHFA) Home Price Calculator.

- Set an irresistible asking price using psychological principles and market strategies, such as the ’99’ strategy or price banding.

- Stay on top of the market’s movements and fluctuations using market analysis and research. Identify and interpret the market signals and patterns that matter.

- Use market data and feedback analysis to adjust your price and stay flexible in a fluid market. Decide when and how to change your price.

- Enhance your home value, appeal and demand using simple strategies, such as decluttering, staging and cleaning your home.

By following these steps to price your house for sale, you’ll increase your chances of selling your home quickly and profitably. And don’t forget, try to enjoy your home-selling journey!