Paperwork for selling a house By Owner in Illinois

Selling a house without a realtor requires various paperworks including pre-listing documents (original sales contract, property survey, mortgage statements), listing documents (Comparative Market Analysis), disclosure documents (Seller Disclosure Statement), negotiation documents (pre-inspection report, purchase offer forms), and closing paperwork (home inspection report, deed, title reports).

Legal consultation can ease the process.

A. Pre-Listing Documents

- Original Sales Contract,

- Property Survey,

- Mortgage Statements,

- Payoff Estimate from Lender,

- Utility and Property Tax Records,

- Homeowners Insurance Records,

- Homeowners Association Agreements and Rules,

- Home Repair, Maintenance Records

- Receipts for Capital Improvements, and

- Manuals and Warranties for Appliances Included in the Sale

B. Listing Documents

- Comparative Market Analysis (CMA),

- Seller’s Net Sheet,

- Preliminary Title Report and

- Certificate of Compliance or Occupancy.

C. Disclosure Documents and Legal Requirements

- Seller Disclosure Statement,

- Lead-Based Paint Disclosure,

- Radon Disclosure and

- State, County and City-Specific Disclosures.

D. Documents Needed During the Negotiation Process

- Pre-Inspection Report,

- Purchase Offer and Counteroffer Forms,

- Final Purchase/Sale Agreement with Contingency Clauses,

- Contingency Removal Form.

E. Closing Paperwork

- Home Inspection Report,

- Home Appraisal Report,

- Deed, Title Reports and Title Insurance,

- Closing Statement and

- IRS Form 1099-S.

Overwhelmed with the paperwork for selling a house by owner in Illinois? Our comprehensive guide simplifies the process, providing step-by-step assistance, ensuring a seamless and efficient home sale on your own terms.

FSBO Paperwork Forms

Here’s a list of free download links to the forms mentioned in the article:

- Purchase Agreement Forms:

- Create or download your purchase and sale agreements from here

- Sample Purchase and Sale Agreement

- Property Survey sample:

- Residential Real Property Disclosure Report Form:

- Obtain the form from Residential Real Property Disclosure Report

- Lead-Based Paint Disclosure form:

- Radon Disclosure form:

Remember that some of these links are samples, and it’s essential to find or create the documents specifically tailored to your needs and state laws.

For Buyers

Buying FSBO? Navigate paperwork easily with our legal support. Ensure a smooth transaction!

For Sellers

Selling FSBO? Our comprehensive legal services make paperwork and transactions a breeze.

Call now & Get a Free Consultation!

Special Offer: Mention this website and get a free consultation on your first service!

Let’s discuss in detail each of the paperwork involved in selling your house without a realtor.

A. Pre-Listing Documents

Before listing your property, you need to gather and organize several essential pre-listing documents.

1. Original Sales Contract

The sales contract, also known as the purchase agreement or sales agreement, is a legally binding contract between the seller and the buyer.

This document outlines the terms and conditions of the sale, including the purchase price, contingencies, financing details, and closing date.

To obtain the original sales contract,

- You may retain a real estate attorney who can draft the document for you

- Or, you can use standard form contracts or templates available through a real estate website. You will want to find one specifically tailored to your state’s laws.

Purchase Agreement Forms:

- Create or download your purchase and sale agreements from here

- Here’s a sample purchase and sale agreement

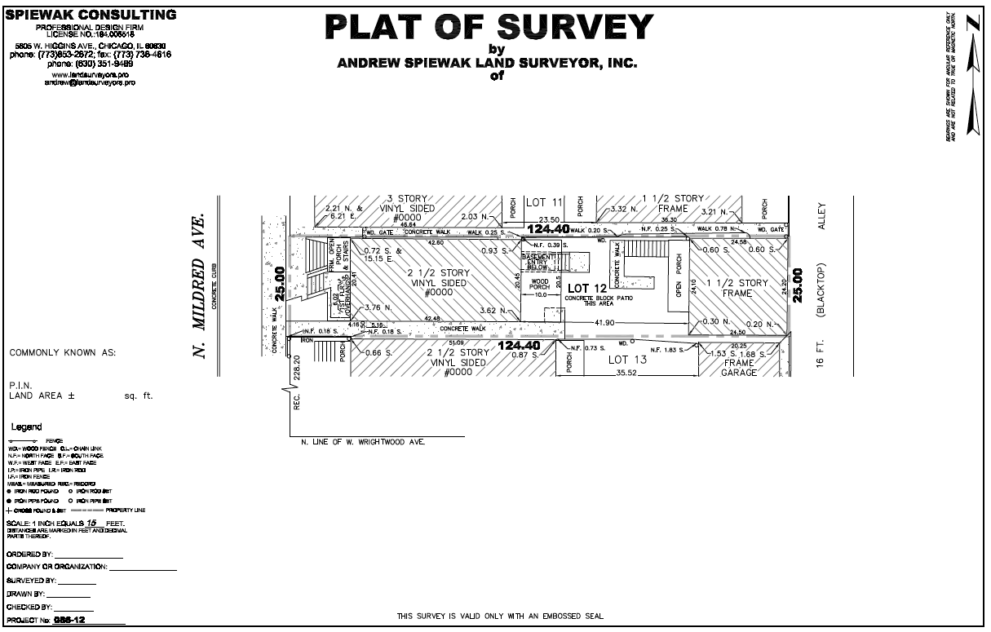

2. Property Survey

A property survey is a document that outlines the boundaries, dimensions, and improvements on your property. The property survey shows the location of buildings, fences, driveways and other structures, ensuring potential buyers understand the property’s layout.

To obtain a survey, you can hire a licensed surveyor who will visit your property and create a detailed map. The surveyor will mark the property lines, identify any encroachments, and provide a certified survey report.

Property Survey sample

Here’s a sample property survey of a single-family home in Chicago.

3. Mortgage Statements and Payoff Estimate from Lender

If you still have an outstanding mortgage on your property, you should obtain the most recent mortgage statement from your lender. These statements provide information on the remaining balance, interest rate, and monthly payments.

The payoff letter from your lender specifies the exact amount needed to pay off your mortgage in full, including any prepayment penalties or interest that has accrued.

You can calculate a mortgage payoff amount using a formula, but it can be confusing, so it’s easier to have your lender make the calculations and send you a mortgage payoff statement.

To obtain a payoff quote:

- Contact your mortgage lender and request a payoff estimate.

- Provide your mortgage account number and any other information your lender may require.

- Your lender will then calculate the payoff amount and provide you with a written confirmation of the estimate.

Or, you can also use a mortgage payoff calculator to estimate your payoff amount. There are several online calculators available, such as Mortgage Payoff Calculators from

These calculators allow you to input information such as your original mortgage loan amount, current interest rate and additional payments you plan to make, and provide an estimate of your payoff amount at a future date.

4. Utility and Property Tax Records

When welcoming prospective buyers, sharing records of utility bills and property taxes can offer a revealing glimpse into the cost of the property’s upkeep.

These documents shed light on the regular costs the buyer can anticipate when taking ownership.

- For utility records, all it takes is a quick call to your service providers – water and sewer, electric, gas – and request your billing history over the last year.

- As for property tax records, a simple visit to your county tax assessor website should do the trick.

Get ahold of the most recent tax statement and double-check it for accurate reflection of your property’s tax assessment.

5. Homeowners Insurance Records

Homeowners insurance is the trusty shield against property damage, liability claims and those sudden curveballs life can throw.

As part of the house-selling process, it’s a good idea to share the records of your homeowners insurance coverage with potential buyers.

Reach out to your insurance provider and request a copy of your insurance policy declarations page. This document neatly packages the coverage details, policy limits, and any applicable deductibles.

- The Comprehensive Loss Underwriting Exchange (CLUE) report is a claims history database used by insurance companies.

- You can request a CLUE report online, via mail, or by directly contacting LexisNexis.

6. Homeowners Association Agreements and Rules

If your property is governed by a homeowners association (HOA), potential buyers will need copies of the HOA agreements, rules, regulations, and current budget and assessment information. These legal documents paint a picture of the rights, responsibilities, and quirks that define life within the community.

A quick call to your HOA can secure you the most current version of the HOA agreements, including the bylaws, covenants, conditions, and restrictions. Make sure potential buyers are fully in the loop about the HOA rules and any associated fees.

7. Home Repair, Maintenance Records and Receipts for Capital Improvements

A well-kept record of home repairs, maintenance, and capital improvements can be a compelling testament to your property’s condition when selling. It’s a tangible expression of care and attention that buyers can appreciate.

So, dust off your receipts and records for any property sprucing you’ve done – roof repairs, HVAC system maintenance, kitchen upgrades, and so on. Include the nitty-gritty like the work done, dates and costs incurred.

8. Manuals and Warranties for Appliances Included in the Sale

Planning to include major appliances as part of the sale? Try to include a handy manual or warranty for the new refrigerator or oven!

Offering these documents to buyers ensures they know how to use, care for, and claim warranty coverage for the included appliances.

Gather the manuals for all included appliances – refrigerators, ovens, dishwashers, washers, dryers, and any other items that will stay with the property.

If any warranties are transferable to the new owner, do include them. It’s a small gesture that can go a long way in putting your buyers at ease.

Selling your home as a For Sale By Owner (FSBO) can help you save money on agent commissions.

Setting the right price is crucial when selling your house by owner.

B. Listing Documents

You’ve got your pre-listing documents in order, now let’s focus on the paperwork to bring your property to the market.

The right documents can be your ace in the hole when it comes to setting a competitive listing price and painting a detailed portrait of your property for potential buyers.

1. Comparative Market Analysis (CMA)

Think of a Comparative Market Analysis, or CMA, as your property’s backstage pass to the real estate market. This report will give you a solid foundation for the fair market value of your property, taking into account factors like location, size, condition and amenities, all in comparison with recent local sales.

You can get your hands on a CMA through a real estate agent or by using online tools on real estate websites.

- You can perform your own comparative market analysis by researching comparable properties and your home’s fair market value (known as “comps”) on real estate listing sites, such as realtor.com or Zillow

- You can also use online guides and tools to help you create a CMA report, such as those provided by Maxrealestateexposure, The Close and Kyle Handy

2. Seller’s Net Sheet

The Seller’s Net Sheet is like a crystal ball for your finances post-sale. This document provides an estimate of what you’ll walk away with after expenses like realtor fees, closing costs, and outstanding loan balances have been taken into account.

You can use online calculators to draft a Seller’s Net Sheet, or work with a real estate lawyer who can help you prepare one.

3. Preliminary Title Report or “Prelim”

Your property’s autobiography, the Preliminary Title Report or title commitment, is a crucial component of your listing documents. It tells the story of the property’s ownership history and any encumbrances or liens.

A title company can furnish this report by conducting a title search, providing valuable insights into the property’s title status for potential buyers.

- Request a Preliminary Title Report from your real estate lawyer

- Your attorney provides the title agency with information about the property, such as its address and legal description.

- The title company conducts a title search of public records to determine the current status of the property’s title and provide you with a title commitment.

- Pay for the Report

- The title company may provide you with a commitment for a fee or even for free, if it’s ordered in anticipation of closing the real estate transaction at that title agency.

- Review the Report

- The Preliminary Title Report will provide details regarding the title and the background of the property.

- Review the report carefully to ensure that there are no issues with the property’s title that could affect the sale or purchase of the property.

- Address Any Issues with the Title

- If the title commitment reveals any issues with the property’s title, work with your real estate lawyer to address them before proceeding with the real estate transaction.

- Your attorney can provide guidance on how to resolve any issues with the title.

4. Certificate of Compliance or Occupancy

Depending on your local municipality, you might need an inspection or Certificate of Compliance or Occupancy in order to transfer your home to the buyer. It acts like a seal of approval from your municipality that the property is up to snuff with payments, building codes, zoning regulations and safety requirements.

- Contact your local building department or municipal government office.

- The building department or code enforcement office may be responsible for issuing certificates of compliance or occupancy.

- You can find the contact information for your local building department or code enforcement office through your city or village website.

C. Disclosure Documents and Legal Requirements

Providing potential buyers with necessary information about the property’s condition and known issues is both required and shows good faith.

1. Seller Disclosure Statement (Property Defects or Dangers)

The Seller Disclosure Statement is where you declare any known defects or material facts about the property.

It helps buyers make informed decisions and protects you from potential legal headaches down the line.

You can work with a real estate lawyer or use state-specific forms available on real estate websites to prepare seller disclosure forms.

Here are the steps to get a Home Seller Disclosure Statement in Illinois:

- Review the Residential Real Property Disclosure Act

- The Residential Real Property Disclosure Act requires sellers to provide a disclosure report to interested buyers.

- The disclosure report must be made in a specific form provided by the Act that includes mandatory disclosures.

- Obtain the Residential Real Property Disclosure Report Form

- You can obtain the Residential Real Property Disclosure Report form from the Illinois General Assembly website.

- Fill out the Form

- Provide information about the property, such as its age, condition and any known defects or issues.

- Sign and date the Form

- The seller must sign and date the disclosure report to certify that the information provided is accurate to the best of their knowledge.

2. Lead-Based Paint Disclosure (For Homes Built Before 1978)

If your property was built before 1978, you’ll need to provide buyers with a Lead-Based Paint Disclosure.

This document alerts buyers to the possible presence of lead-based paint and the risks associated with it.

Use the Lead-Based Paint Disclosure form provided by the Environmental Protection Agency (EPA) or consult a real estate lawyer to ensure compliance with federal regulations.

3. Radon Disclosure

In Illinois, sellers aren’t required to test for radon but must provide a Radon Disclosure Pamphlet if tested. The pamphlet educates buyers about radon exposure and their rights during the purchase process.

Radon, a naturally occurring radioactive gas, can seep into homes from the soil and pose health risks. Testing is necessary since it’s odorless and colorless.

Including a radon disclosure in FSBO paperwork benefits both parties.

- For sellers, it shows transparency and due diligence, making the property more appealing.

- It also protects them from future legal claims related to undisclosed radon issues.

- For buyers, it provides important information about potential health concerns.

You can find the Radon disclosure form here.

4. State, County and City-Specific Disclosures

Depending on where your property is located, there may be additional state, county, or city-specific disclosures required. These can range from environmental hazards to earthquake zones to floodplain information.

Research the specific disclosure requirements for your property’s location or work with a real estate lawyer who is well-versed in local regulations.

Remember: while this may seem like a lot, each document plays a crucial role in providing transparency and building trust with interested buyers. And of course, when in doubt, don’t hesitate to seek the counsel of a real estate lawyer to guide you through this process.

D. Documents Needed During Negotiation Process

You’re set to negotiate with your prospective buyers! Here’s a checklist of the documents you might need during this stage, which are usually taken care of by real estate agents:

1. Pre-Inspection Report

A pre-listing inspection conducted by the seller allows you to assess the property’s condition and address potential issues. This proactive approach can enhance a home’s appeal, build trust with buyers and lead to smoother negotiations.

To obtain a pre-home inspection report:

- Find and hire a reputable home inspector

- Schedule and attend the inspection

- Review the detailed written report

It’s worth noting that buyers may still want to carry out their own home inspection, due to concerns about conflicts of interest or objectivity in a seller-initiated report. A buyer’s inspection can provide additional peace of mind for both parties involved in the transaction.

2. Purchase Offer and Counteroffer Forms

When buyers submit a purchase offer, they will provide a form outlining the proposed purchase price, contingencies and other terms.

As the seller, you will review the offer and may need to prepare a counteroffer if you wish to negotiate specific terms.

Consult a real estate lawyer or use state-specific purchase forms to respond to buyer offers. Carefully consider the terms proposed, including the purchase price, contingencies and desired closing date.

3. Final Purchase/Sale Agreement with Contingency Clauses if Applicable

Once the negotiation process is complete, and both parties agree on the terms, a final Purchase/Sale Agreement is prepared.

- This document outlines the agreed-upon terms, including the purchase price, contingencies, financing details and closing date.

Consult a real estate lawyer or use state-specific purchase/sale agreement forms to prepare the final agreement.

Ensure that all agreed-upon terms are clearly stated, including any contingency clauses, such as a financing contingency or a home sale contingency.

4. Contingency Removal Form

If the buyer’s contingencies are satisfied or waived, they may provide you with written confirmation of Contingency Satisfaction or Removal. This confirms that the contingencies specified in the Purchase Agreement have been met or removed, moving the sale closer to closing.

Review the Contingency Removal form provided by the buyer or buyer’s agent and ensure that all specified contingencies have been addressed and satisfied.

E. Closing Paperwork

As the date of closing draws nearer, a variety of documents come into play to wrap up the sale. While this paperwork may seem excessive, it helps pave the way for a seamless change of ownership, simplifies the closing process, and protects the rights of both the buyer and the seller.

Here’s a quick look at the main documents involved in closing:

1. Home Inspection Report

Think of the home inspection report as your home’s report card.

If the buyer requires a home inspection as part of the purchase agreement, the inspection report will detail any issues identified during the inspection, such as roof leaks, electrical problems, or structural damage.

- The inspection report can act as a bargaining chip for the buyer to negotiate repair requests or ask for credits.

As the seller,

- You’ll need to decide whether or not you want to address the repair requests or offer a credit towards the final sale price.

- For example, if the report uncovers a faulty water heater, you could either fix it or offer a credit so the buyer can replace it after the purchase.

2. Home Appraisal Report (if Lender Involved)

A home appraisal report is a bit of a reality check for the price tag you’ve placed on your home.

If the buyer is securing financing, their lender will likely require a home appraisal. This report offers an independent assessment of your property’s value based on factors like its condition, location and comparable sales in the area.

- While you may not directly obtain this report, it’s essential to know it plays a significant role in the buyer’s mortgage approval process.

- You can’t control this report, but keeping your home in top condition and understanding your local market can help ensure a favorable appraisal.

- You can also prepare a list of comparable properties that have recently sold in your area to share with the appraiser.

3. Deed, Title Reports and Title Insurance

The deed and title reports are the legal documents of the property transfer process.

- The deed is the document that officially transfers ownership from you to the buyer.

- The title report, also referred to as title commitment, provides a detailed history of the property’s ownership and reveals any encumbrances or liens on the property, such as a mechanics lien from an unpaid contractor or a pending lawsuit.

You’ll need to work with a real estate lawyer and title company to prepare the necessary deed and obtain title reports.

Let’s say your house was inherited, and your Aunt Mary still technically has a stake in the property.

- A title report would catch this, and you’d need to resolve it before transferring the deed.

Title insurance is also recommended as it acts like a safety net, protecting the buyer and/or lender from any potential title defects or claims that may arise in the future.

4. Closing Statement or Settlement Statement

The closing statement, also known as the settlement statement, is the financial compass of the sale.

- This statement gives a detailed breakdown of all the financial transactions related to the sale, such as the purchase price, closing costs, prorated property taxes, mortgage payoffs, payments to third parties and any credits or adjustments.

- A real estate lawyer or closing agent will prepare the closing statement.

As the seller, you should review this document with a fine-toothed comb. Ensure all calculations are accurate and that the financial terms align with the Purchase Agreement.

5. IRS Form 1099-S (if applicable)

The IRS Form 1099-S is the official tax record of your real estate sale.

- In some situations, you might be required to complete this form, which reports the proceeds from the sale of your home to the Internal Revenue Service.

- You’ll need to fill this out if you aren’t eligible for the primary residence capital gains exclusion.

Consult a real estate lawyer or tax professional to determine whether you need to complete IRS Form 1099-S. They’ll guide you through the process and provide the necessary instructions.

Who draws up contract in for Sale by Owner?

When it comes to drafting the contract for selling your house, you’ve got a couple of options.

- You can take a DIY approach and use standard forms or templates

- You can enlist the help of a real estate lawyer (like me)

An attorney ensures your real estate contract complies with state and local laws and shields your interests as the seller. Whether or not you hire one depends on how comfortable you are dealing with legal documents, and the complexity of your real estate transaction.

If you’re not sure, or if there are special circumstances involved, it’s usually a good idea to have an attorney take a look and make sure the contract is correctly prepared and legally binding.

For Buyers

Buying FSBO? Navigate paperwork easily with our legal support. Ensure a smooth transaction!

For Sellers

Selling FSBO? Our comprehensive legal services make paperwork and transactions a breeze.

Call now & Get a Free Consultation!

Special Offer: Mention this website and get a free consultation on your first service!

Organizing Paperwork: The Key to a Smooth For-Sale-By-Owner Home Transaction

Keeping all of your documents organized and having them handy is key to making the home selling process a breeze.

Picture this: Potential buyers are knocking on your door, eager to know more about property taxes, utility bills, or other details of your home.

- Being able to provide accurate information right off the bat not only shows you’re transparent but also paves the way for a trusting relationship between you and prospective buyers.

- A well-organized documentation system works wonders in reducing risks linked to possible legal issues later on.

- Making sure you have all necessary permits, property surveys, inspection reports, service records, and title information at the ready helps prevent any disputes over property boundaries or hidden defects that might pop up down the road.

Key Advantages of Opting for a For-Sale-By-Owner (FSBO) Home Sale

While real estate agents provide valuable expertise and support, selling a house without a real estate agent can offer several advantages:

1. Cost Savings:

Realtor commissions can range from 5% to 6% of the home sale price, which can amount to a substantial sum.

- For instance, for a $300,000 home, the commission could be between $15,000 and $18,000 — no small change by any measure.

- FSBO sellers have the opportunity to save these costs, controlling the home selling process and potentially pocketing more profit from the sale.

2. Control and Flexibility:

You set the listing price, marketing strategy and terms. You can also be more flexible with showings and open houses, accommodating your schedule and preferences.

3. Direct Communication with Buyers:

As the owner, you have direct contact with potential buyers, allowing for more personalized interactions. This direct communication can foster trust, provide you with a better understanding of the buyer’s needs, and potentially result in smoother negotiations.

4. Local Knowledge and Involvement:

As a homeowner, you possess intimate knowledge about your property and the surrounding neighborhood. This familiarity can be valuable during showings and negotiations, allowing you to highlight the unique features and benefits of your home.

Selling your home yourself has perks, but it takes effort.

Legal Representation and Assistance Options

In the journey of selling your home on your own, you might find yourself needing some legal guidance or assistance to make sure everything goes smoothly and in compliance with the law.

Let’s dive into the various options you have at your disposal:

The Role of A Real Estate Attorney in FSBO Transactions

A real estate attorney is there to make sure you don’t get lost in the paperwork of a FSBO sale, to keep you safe from potential pitfalls, and to make sure you’re well-represented every step of the way.

In my years of practice, I’ve helped countless homeowners like you by preparing and reviewing contracts, advising on legal requirements, and standing by their side during negotiations and the closing process.

If you choose to bring an attorney on board, make sure to pick someone who specializes in FSBO transactions.

A good attorney will make sure:

- Your paperwork is spot on

- Your rights are protected

- You get the best legal advice at every turn of the process.

Call now & Get a Free Consultation!

Special Offer: Mention this website (Northsidelegal.com) and get a free consultation on your first Real estate attorney service!

Conclusion

Selling a house by owner without a Realtor in Chicago can be an adventure.

- You save on Realtor fees and have more control over the process;

- Yet it’s also a journey that requires a clear understanding and careful organization of all the necessary paperwork.

Throughout this detailed guide, we’ve walked through:

- The critical paperwork involved in selling your house in Chicago

- Why selling without a Realtor might be right for you

- Pre-listing documents

- Listing documents

- Disclosure documents

- Negotiation documents

- Closing paperwork

- Options for legal representation and assistance

By adhering to these guidelines and utilizing the provided links to the forms, you should be well-equipped to navigate the paperwork needed for a successful FSBO sale.

Even if you choose not to hire real estate agents, don’t forget to engage professionals such as real estate attorneys when necessary to ensure legal compliance and to safeguard your interests throughout the home sale process.

Selling a house by owner might come with its challenges, but with the right preparation, organization and understanding of the paperwork involved, you’re paving the way for a successful and financially rewarding sale.