What are closing costs on a house?

When you buy or sell a house, closing costs refer to all the extra fees and expenses you pay to finalize the deal, on top of just the home’s purchase price. Closing costs can really add up and typically include the following:

- Loan origination fees charged by the lender

- Appraisal and credit report fees

- Title search and insurance costs

- Surveys to map property lines

- Recording the new deed and mortgage

- Prorated property taxes

- Homeowners Insurance

- Transfer taxes

- Attorney fees

- Private mortgage insurance premiums

- Escrow account setup and funding

- And plenty more smaller fees!

Basically, closing costs cover all the administrative tasks and legal work needed to transfer property ownership from seller to buyer officially. Both parties have to pay certain closing fees at the closing table.

How much are closing costs on a house?

Closing costs on a house typically amount to 3-4% of the purchase price, meaning for a $300,000 home you could expect to pay around $9,000 to $12,000. Additional fees may arise close to the closing date. Sellers also have expenses such as real estate agent commissions (5-6% of sale price) and other closing fees (2-4% of sale price). Buyers should consider their cash to close, including down payment and upfront expenses like prepaid taxes and insurance, which can range from 2% to 5% of the purchase price.

1. Buyer’s Closing Costs

When buying a home, you can expect to pay around 3-4% of the purchase price in closing costs. So for a $300,000 house, your closing costs could run $9,000 to $12,000. Some buyers may get down payment help to lower these upfront fees.

2. Seller’s Closing Costs

On the seller side, the big expense is real estate agent commissions if you list with a broker. Those typically run 5-6% of the sale price. Beyond commissions, sellers also pay an estimated 2-4% of the sale price in other closing fees like title and legal costs.

In Summary

So in total, both buyers and sellers face thousands in extra closing fees and expenses when transferring property ownership. It’s important to budget and prepare for these costs. Lenders and real estate agents can provide closing cost estimates for your transaction. Just know that additional fees often pop up near the closing date.

When calculating closing costs, buyers should also factor in their cash to close, which includes the down payment and other upfront expenses such as prepaid taxes and insurance.

Cash to close can range from 2% to 5% of the home’s purchase price. Budgeting for these costs in addition to the closing costs themselves, is essential to ensure a smooth home-buying process.

Closing Costs Calculation for Buyers and Sellers

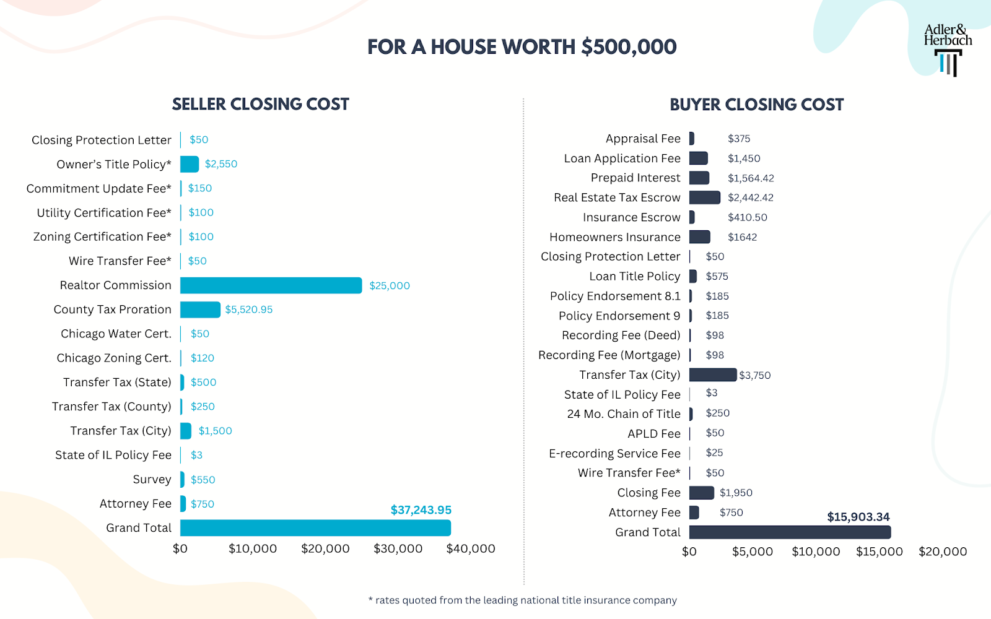

Here is an example of actual Seller and Buyer Closing Costs on a $500,000 house sale in Chicago, Illinois:

* Adler & Herbach offers these fees at a 50% discount to the amounts shown. For a detailed estimate of your closing costs, contact Adler & Herbach.

How Much Are Closing Costs For Buyers?

Closing costs for buyers include property-related fees such as appraisal fees (around $350 to $500), home inspection fees ($500 to $750), and property tax escrow based on the property tax rate. Title-related costs include lender’s title insurance ($585), while mortgage-related fees encompass credit report fees (less than $50), loan origination fees (0.5% to 1% of the loan amount), and application fees (less than $500).

Other costs include attorney fees ($500 to $1000), closing or escrow fees (starting at $1,650 in Chicago), courier fees ($25 to $50), and government recording fees ($98 per document in Cook County). Additional fees include homeowner association transfer fees ($200 to $500), first-year homeowner’s insurance premiums (over $1000), and various inspection fees. Transfer taxes are also applicable based on the purchase price.

1. Property-related fees

A. Appraisal fee

The appraisal fee pays for having a professional appraiser evaluate what the property is worth. An appraisal costs around $350 to $500 on average, but the exact fee varies depending on the size and details of the property.

B. Home inspection fee

The home inspection fee is what you pay to have a professional home inspector check the property and identify any problems that could impact value or safety. A standard home inspection costs about $500 to $750 usually, but the fee changes based on how big the house is and its age.

C. Property tax escrow

Property tax escrow means funds that are collected at closing and held in an escrow account to pay upcoming property tax bills. The amount put into escrow is determined by looking at the total property tax rate and when the next tax payment is due.

2. Title-related costs

Lender’s title insurance

Lender’s title insurance is a policy that protects the lender if any issues are found in the property’s title or deed during the transaction. For a residential property, a lender’s title insurance typically costs around $585 in fees.

Learn more about how much title insurance costs in Illinois.

3. Mortgage-related fees

A. Credit report fee

The credit report fee pays for pulling the home buyer’s credit report, which usually costs less than $50.

B. Loan Origination fee

The loan origination fee covers the processing work of getting the mortgage loan approved for the buyer. This fee is charged as a percentage of the total loan amount, ranging from 0.5% to 1% of the loan total.

C. Application fee

The application fee pays for handling the buyer’s mortgage loan application. This cost varies by lender but is often less than $500. Some lenders do not charge an application fee at all.

D. Discount points

Discount points are optional fees, equal to 1% of the loan amount, that the buyer can pay to receive a lower interest rate on their mortgage loan.

E. Underwriting fee

The underwriting fee is what you pay the lender to review your loan application and finances. This fee is usually less than $1,000, but can vary by lender. Some lenders charge this fee instead of an origination fee. Some lenders charge it as an extra cost on top of origination. And some lenders don’t charge an underwriting fee at all or are open to negotiating it.

F. Private Mortgage Insurance premium (PMI)

Private mortgage insurance, known as PMI, is required if you make a down payment of less than 20% of the home purchase price.

- There is an upfront PMI premium that gets added into the total loan amount you borrow.

- Then there is also an annual PMI premium that gets added to your monthly mortgage payment.

G. FHA Loans

For FHA loans from the Federal Housing Administration, you pay an upfront mortgage insurance premium of 1.75% of the full loan amount. You also have to pay an annual mortgage insurance premium, and that amount changes based on factors like the loan amount, down payment, and loan term.

H. USDA Loans

USDA loans from the Department of Agriculture are for rural buyers with low or moderate incomes. You pay an upfront guarantee fee of 1% of the loan amount. And you pay an annual fee of 0.35% of the loan amount.

I. Veterans Affairs funding fee

VA loans (through the Department of Veterans Affairs) for veterans, active military, and eligible surviving spouses don’t require regular PMI. But VA loans charge a funding fee that goes to the VA.

This funding fee ranges from 1.4% to 3.6% of the loan amount, depending on your down payment and if you’ve used a VA loan before.

4. Attorney fee

The attorney fee can vary but typically ranges from $500 to $1000. The attorney fee is for legal representation during the purchase process and for ensuring all documents are in order.

For Buyers

Learn how to calculate and reduce closing costs in Illinois. Our real estate attorneys can guide you, offering transparency and minimizing financial burdens.

For Sellers

Save on closing costs when selling your home. Consult our experienced real estate attorneys to identify potential savings and make the best financial decisions at closing.

Call now & Get a Free Consultation!

Special Offer: Mention this website and get a free consultation on your first service!

5. Closing or Escrow Fee

The closing or escrow fee pays for the title company that manages the closing process. This fee starts at around $1,650 in the Chicago area and increases based on the purchase price of the property. Typically the buyer pays the closing fee, except in a cash transaction when it is split between the buyer and seller. This fee covers the title company’s services like preparing all the closing documents and disbursing the funds to the correct parties.

6. Courier Fee

The courier fee ranges from $25 to $50 and pays for overnight delivery services to ship the loan documents.

7. Flood Determination and Monitoring Fee

The flood determination and monitoring fee costs between $10 and $20. This covers the cost of checking if the property is located in a government-designated flood zone. It also pays for monitoring the property for any changes to the flood zone boundaries over time.

8. Government Recording Fees

Government recording fees charged by the county recorder’s office pay for officially recording the new property deed and mortgage in public records. In Cook County, Illinois, each document recording costs $98.

9. Homeowner Association Transfer Fee

For properties that are part of a homeowner’s association, there is usually a transfer or move-in fee when purchasing the property. This averages around $200 to $500.

10. First-Year Homeowner’s Insurance Premium

Lenders require homeowner’s insurance for mortgaged properties. The first year’s insurance premium, which is over $1000 on average, must be paid upfront at closing.

11. Lead-Based Paint Inspection Fee

For homes built before 1978, the seller must provide a lead-based paint disclosure. The buyer can optionally pay for a professional lead paint inspection, which costs around $200 to $300, if concerned about exposure.

12. Pest Inspection Fee

The buyer may also choose to pay for a professional pest inspection of the property before closing. This costs around $100 to $150 on average. It checks for termites, ants, rodents, or other pest infestations.

13. Prepaid Daily Interest Charges

Prepaid daily interest charges cover the mortgage interest that accrues between the closing date and the end of the month. This fee is calculated by multiplying the mortgage loan amount by the interest rate and dividing that by 365 days.

14. Rate Lock Fee

Sometimes there is a rate lock fee charged to lock in a specific mortgage interest rate. This is typically around 0.25% to 0.5% of the total loan amount. It is often built into the rate instead of a separate fee.

15. Tax Monitoring and Status Research Fees

Lenders may charge tax monitoring and tax status research fees to check for any outstanding property taxes or tax liens on the property. These fees range from $75 to $200 in most cases.

16. Transfer Taxes

Transfer taxes are charged by the state, county, and city when real estate is transferred. The taxes are based on the purchase price. In most of Illinois, the seller pays the state and county transfer taxes. In Chicago, the seller also pays part of the city tax but the buyer covers a portion too.

How To Reduce Closing Costs For Buyers?

To reduce closing costs for buyers, follow these strategies: shop around for a lender, avoid discount points, negotiate with the seller, schedule the closing at the end of the month, compare loan estimate and closing disclosure forms, explore rebates and incentives, roll closing costs into your mortgage, and negotiate real estate commissions.

1. Shop Around for a Lender

One of the most effective methods to cut costs is researching different lenders for the best loan. Lenders offer varying rates and fees, and a thorough comparison can uncover a lender with lower interest rates and closing costs.

2. Avoid Discount Points

Discount points are prepaid interest that can be paid to lower your mortgage interest rate. While this may seem like a good idea, it can actually increase your closing costs.

Avoid paying discount points if you want to reduce your up-front mortgage closing costs. On the other hand, if you plan to have your mortgage for a while, paying discount points can reduce your interest rate and monthly payment, saving you a lot of money over the life of the loan.

3. Negotiate with the Seller

Another cost-cutting tactic is to negotiate with the seller. While it may not always be feasible, asking the seller to contribute towards your closing costs can significantly impact your required down payment.

4. Schedule Your Closing at the End of the Month

Prepaid interest accrues between the time you close on your home and the end of the month. So when you schedule your closing at the end of the month, you have less prepaid interest to pay.

5. Compare the Loan Estimate and Closing Disclosure Forms

A careful review of your loan estimate and closing disclosure forms can help you spot any mistakes or discrepancies that could be causing inflated expenses. Addressing these items line by line with your lender can sometimes result in savings.

6. Explore Rebates and Incentives

Some lenders offer rebates and incentives to help you save money on closing costs. Make sure to ask your lender if they have any programs or options for this.

7. Roll Closing Costs into Your Mortgage to Reduce the Down Payment

Rolling closing costs into your mortgage is also an option if you struggle to cover the upfront costs. While this may lead to a higher monthly payment, it can help you avoid a substantial upfront mortgage payment.

8. Negotiate Real Estate Commissions

If you’re working with a real estate agent, negotiate their commission. This can help you save money on your closing costs.

How to Prepare for Closing as a Buyer?

As a buyer, follow these 5 steps to prepare for your closing.

1. Obtain a loan estimate from your lender:

Within 3 days of receiving your home loan application, your lender is required by law to provide you with a loan estimate outlining the estimated closing costs for closing with your specific loan. While this estimate will not be 100% accurate, it will guide you on what you can reasonably expect to pay.

2. Review the loan estimate:

Reviewing your loan estimate carefully to see which closing costs are included and your total out-of-pocket expenses is important.

3. Compare estimates:

If you’re getting loan estimates from multiple lenders, compare them side-by-side to see which one offers the lowest overall closing costs.

4. Talk to your real estate agent:

Your real estate agent can also help you estimate the closing costs by providing insight into average closing costs in your local area and recommending reputable service providers.

5. Prepare for the closing:

Ensure you have the funds to cover the closing costs and down payment. They are usually paid by wire transfer or cashier’s check.

Who Pays Closing Costs on a House in Illinois?

In the state of Illinois, it is customary for both buyers and sellers to contribute towards the payment of closing costs when purchasing a house.

- Sellers typically cover expenses such as real estate agent commissions, title insurance, transfer taxes, and attorney fees.

- On the other hand, buyers are usually responsible for costs like loan origination fees, appraisal fees, and prepaid property taxes.

Note that these expenses can be subject to negotiation, and there are strategies available to potentially reduce them, such as exploring different lenders and engaging in negotiations with the seller.

Who pays closing costs on Conventional FHA & USDA Loans?

Closing costs for different loan types such as conventional, FHA, or USDA can be paid by either the buyer or the seller. Generally, buyers are responsible for most of the closing costs, but sellers can contribute a portion depending on the buyer’s down payment size. The typical closing costs range from 2-5% of the home purchase price.

Many of the fees listed below only apply to a buyer that is financing the purchase with a loan. A cash buyer will not have any of the lender-related fees.

1. Closing Costs for Conventional Loans

For conventional mortgage loans, the buyer is generally responsible for paying the majority of the closing costs, excluding realtor commissions. These costs paid by the buyer include fees for the appraisal, credit report, flood certification, buyer’s attorney, loan origination, discount points, and settlement. Total closing costs for buyers with a conventional loan are typically around 2-5% of the home purchase price.

However, sellers can agree to cover a portion of the buyer’s closing costs to help close the deal and make the deal more appealing to buyers. The amount the seller is allowed to contribute depends on the buyer’s down payment size.

- If the down payment is less than 10% of the purchase price, the seller can pay up to 3% of the price toward the buyer’s closing costs.

- If the down payment is 10-25% of the price, the seller can contribute up to 6% toward buyer costs.

- If the down payment exceeds 25% of the purchase price, the seller can pay up to 9% of the price toward the buyer’s closing costs.

2. Closing Costs for FHA Loans

For FHA loans, the buyer is responsible for the closing costs associated with a conventional loan, plus an additional upfront mortgage insurance premium of 1.75% of the total loan amount, and an annual mortgage insurance premium between 0.45-1.05% of the loan amount.

The typical closing costs the FHA loan buyer pays range from 2-5% of the purchase price, excluding realtor commissions.

For FHA loans, the seller can contribute up to 6% of the home’s purchase price toward the buyer’s closing costs.

3. Closing Costs for USDA Loans

With a USDA home loan, closing costs include most of the same fees as a conventional loan. There is also a one-time guarantee fee of 1% of the loan amount and an annual fee of 0.35% of the loan amount. The USDA guarantee fee can be rolled into the financed loan amount.

Even with the USDA loan fees, the seller can contribute up to 6% of the purchase price toward the buyer’s closing costs. Additionally, if the appraised value exceeds the purchase price, some or all of the closing costs may be able to be included in the loan amount.

Call now & Get a Free Consultation!

Special Offer: Mention this website (Northsidelegal.com) and get a free consultation on your first Real estate attorney service!

How Much Are Closing Costs For Sellers?

Closing costs for sellers typically include attorney’s fees ($500-$1,000), survey fees ($500-$600), credits towards buyer’s closing costs (around 3%-4% of the sales price), escrow fees (based on the purchase price, ranging from around $1,650 to a few thousand dollars), homeowners association transfer fee ($200-$500), prorated property taxes based on the number of days the seller owned the property, real estate agent commission (usually 5%-6% of the sales price, split between buyer’s and seller’s agents), transfer taxes (based on the property’s value, with additional taxes imposed by counties and municipalities), and owner’s title insurance (premium based on the sale price, ranging from $1,950 to several thousand dollars).

1. Attorney’s fees

When selling a home, having an experienced real estate attorney on your side is always a good idea. An attorney will ensure all the legal paperwork is in place and that the real estate transaction progresses smoothly through closing. The attorney fee can range from $500 to $1,000, depending on the complexity of the sale.

2. Survey fee

A survey is necessary to determine the property’s boundaries and ensure no encroachments or easements on the property. This fee typically ranges from $500 to $600 but can be higher for unusually sized or shaped parcels.

3. Credits toward closing costs

Credits toward closing costs are sometimes offered to buyers by sellers to make their property more attractive. Sometimes, the buyer may request a credit toward their closing costs.

This credit is typically negotiated during the offer and counteroffer stage. So, depending on the final terms of your contract, a seller may be required to offer credits to the buyer to cover certain closing costs.

For example, you may agree to cover a portion of the buyer’s closing costs or offer credits toward repairs or upgrades. These credits can range from a few hundred to several thousand dollars. So technically, the amount of the credit can vary widely and may end up at around 3% to 4% of the sales price.

4. Escrow fees (also closing or settlement fees)

Escrow fees are charged by the title company or closing agent for managing the escrow account, which holds the seller’s funds until the transaction is complete. This fee covers the costs of facilitating the closing, recording the deed and mortgage, and disbursing all the funds to the proper parties.

This fee is based on the purchase price, ranging from around $1650 to a few thousand dollars. It is typically paid by the buyer, except in a cash transaction, where it is split between buyer and seller.

5. Homeowners Association Transfer Fee

If the home is located in a homeowners association (HOA), there may be fees associated with transferring ownership. The fees vary depending on the HOA but are typically around $200 to $500.

6. Prorated Property taxes

Since real estate taxes in Illinois are paid in arrears (meaning the current bill is for the prior year’s taxes), the Buyer will be “paying” for the time you lived in the house. This proration is a credit for the portion of time that you occupied the house, for which the buyer will eventually pay the tax bill.

The prorated amount is typically calculated by dividing the annual tax by 365 and multiplying it by the number of days the seller owned the property during the current tax year.

7. Real Estate Agent Commission

The seller typically pays the real estate agent’s commission, which is usually the highest line item. The commission can vary but is generally between 5% and 6% of the sales price. The commission is split between the buyer’s and seller’s real estate agents.

8. Transfer taxes

The transfer tax is generally paid by the seller and calculated based on the value of the sold property. In Illinois, the transfer tax rate for residential real estate properties is $1 for every $1000 of the home’s value. For example, selling a $300,000 home will merit a $300 tax.

Counties in Illinois may impose an additional 25 cents for every $500 of the property’s value. This means the same $300,000 home sold in a county with an additional tax would add another $150 to the transfer tax. The seller pays these state and county transfer taxes.

Many cities and municipalities also charge their own transfer taxes, though the buyer sometimes pays these. The City of Chicago’s tax rate is currently set at $5.25 per $500.00 of the purchase price. This amount is split between the seller ($1.50 per $500) and the buyer ($3.75 per $500).

It is important to consult with your attorney or agent to determine the total transfer tax and who is responsible for paying it in a specific location.

9. Owner’s Title Insurance

Title insurance protects the buyer in case there are any legal disputes over the ownership of the property. The seller is typically responsible for paying for the lender’s title insurance. The premium is based on the sale price, ranging from $1950 to several thousand dollars.

The seller may also be responsible for paying the title search fee, commitment update fee, closing protection letter (CPL), and other title-related fees, which can add several hundred dollars to the costs.

Through an innovative program, Adler & Herbach is able to offer a 50% discount on seller’s title fees. For an estimate of YOUR savings, see our Sellers page.

Learn more about

The Bottom Line

In conclusion, closing costs can vary greatly depending on the type of loan, the location of the property, and other factors.

It is important for both buyers and sellers to understand the various fees and expenses that are involved in the closing process, from property-related fees to mortgage-related fees, attorney fees, and more.

Buyers and sellers can potentially reduce closing costs by shopping around for the right lender, negotiating with the seller, and exploring rebates and incentives.

Working with an experienced real estate attorney can also help ensure a smooth and efficient closing process.

Adler & Herbach is proud to be at the forefront of the Illinois real estate landscape by partnering with a title agency to offer 50% off seller’s title fees. To get a full analysis of how much you can save, call us now