How Long Does It Take To Close On A House?

In Illinois, the average time from contract to closing on a house can range from 30 to 90 days, depending on various factors. After your mortgage loan starts processing, the entire process of closing a house can take anywhere from 30 to 60 days. If you’re paying with cash, you may be able to close as fast as 7 days after signing the contract.

Factors such as property type, loan type, and contingencies in the contract can affect the closing time. Contingencies are conditions that must be met before the sale can proceed, such as appraisals, inspections, title searches, underwriting, or negotiations.

Insight Report on Closing Timeline

A recent origination insight report by mortgage tech giant Ellie Mae revealed the average home closing time for April 2022 was 52 days (recent study through October 2023). However, this timeline can fluctuate based on the buyer’s financing option.

For instance, conventional loans closed on average in 48 days, while FHA and VA loans took slightly longer at 54 and 57 days, respectively. But, if you have cash in hand, you can significantly speed up the process and close in as little as a week.

Closing Timeline Overview

Imagine you’ve finally found the home of your dreams and are ready to take the next step toward making it yours.

Entering into a purchase agreement, completing the attorney review process, applying for a home loan and obtaining approval on it, applying for and obtaining title insurance, preparing closing documents, doing a final walkthrough, and closing are all part of the exciting yet complex journey of the home purchasing process.

1. How long does it take to close after Putting an offer on a house?

If you put an offer on a house today, the typical range is 4-8 weeks from the time an offer is submitted to the actual closing day.

2. How long does it take to close on a house after Offer is Accepted?

After the offer is accepted, it will take 30 – 45 days to close on a house. Although factors like home inspection, repair negotiations, financing timeline, etc can affect this precise timeline.

3. How long does it take to close on a house after Inspection?

After the home inspection is completed buyers can plan for approximately 3 – 5 weeks until sitting down to sign documents at closing.

4. How long after Home inspection is Appraisal?

After the home inspection is completed, it’s standard to allow 1 -2 weeks until the home appraisal is completed.

5. Can you ask for a price reduction after Home inspection?

After getting the home inspection report, you can go back to the seller and ask for a price reduction or credit. Under standard real estate purchase contracts, buyers can negotiate the purchase price based on any issues uncovered during the home inspeciton.

6. How long after the Appraisal is Closing?

After the home appraisal is completed allow at least 2 – 3 weeks until the closing day. After appraisal the further steps are mortgage loan approval process, underwriting, review closing disclosure, final walkthrough and receive the keys.

7. How long does closing take at the title company?

For most closings at a title company, plan on the appointment taking between 1-2 hours from start to finish. However, first-time homebuyers should set aside 2-3 hours, just in case it runs longer.

8. How long does the signing closing papers take?

For signing closing papers, buyers can plan for 1-2 hours to thoroughly review and execute all closing documents and receive lender approval for funding.

9. Why does closing day take so long?

The closing day takes so long because of the following reasons.

- A thorough document review is essential

- Staggered signings add time

- Waiting periods of 15 to 30 mins are common

- The settlement agent has procedures to follow

- Funds transfer take hours

10. How long after closing do you get your money?

For sellers, funds are available immediately on the closing day. The title company cannot disburse the seller’s proceeds until they have the buyer’s funds in hand and the deed is recorded. But sellers don’t have to wait days or weeks post-closing to get your funds. The proceeds are available either on-site or within the same business day of closing.

How long does the closing process take on a house?

From the perspective of a home buyer: If we take Day 1 as the day in which you make an offer as a buyer, typically it will take up to Day 60 to close on the house. Here’s the complete breakdown of the closing timeline of a home-buyer purchasing the home with a mortgage loan.

- Buyer decides to buy a home and get pre-approved for a mortgage (1-2 months before making the offer)

- Research neighborhoods and housing market (2-3 weeks before the offer)

- Visit homes along with a real estate agent (2-3 weeks before the offer)

- Make an offer on a home (Day 1)

- Negotiate with the seller and have the offer accepted (Day 1 – 7)

- The Home will be taken off the market upon accepted offer

- Buyer will apply for a mortgage if not already done (Day 7 – 14)

- Provide documents for loan application (Day 7 – 30)

- Schedule and complete inspection (Day 7 – 12 Attorney review period – 5 Business days)

- Request any repairs based on inspection (Day 7 – 12)

- Negotiate requested repairs with seller (Day 7 – 12)

- Appraisal completed (Day 12 – 15)

- Mortgage Loan approval process and underwriting (Day 15 – 50)

- Receive and review closing disclosure (Day 27 – 57)

- Conduct final walkthrough (Day 30 – 60)

- Close on purchase and receive keys (Day 30 – 60)

- Seller vacates home on the closing day (Day 60 – 65) or pays for each day they stay after

- Buyer Moves into the new home once vacant (Day 60 – 65)

Factors affecting closing timeline

Final approval for various loan types, such as conventional loans, VA loans, or FHA Loans, can take 3-8 weeks, and sometimes more. FHA and VA loans have additional requirements that can take more time than conventional loans.

The loan approval timeline depends upon

- Specific mortgage lender,

- Down payment amount,

- Buyer’s financial situation,

- Buyer’s credit report.

- Purchase price,

- Title search and examination,

- Collecting and providing all the requested documents to the lender.

Sometimes, closing delays can be caused by:

- Items revealed by the home inspection

- Title issues uncovered during the search and examination of the title

You should also be ready to provide any paperwork and documents that your lender may request and deal with unexpected delays, such as those caused by appraisals and other underwriting requirements.

As so many factors have a significant role to play in the average closing times in Chicago, it can vary depending on them.

How to ensure a smooth closing process?

Work closely with a real estate attorney, mortgage broker, or lender to understand all the steps involved and what to expect.

For Buyers

Easily navigate the Chicago house closing process. Call for a free consultation with our experienced real estate attorneys and close on time with confidence!

For Sellers

Ensure a timely and hassle-free closing in Chicago. Protect your interests with our professional real estate attorney services. Contact us today for a smooth closing.

Call now & Get a Free Consultation!

Special Offer: Mention this website (Northsidelegal.com) and get a free consultation on your first Real estate attorney service!

Your attorney will also work closely with the title company to ensure that the process moves along as quickly as possible.

Closing on a house can be a complicated process that involves a lot of people. Anyone who wants to buy or sell a house should be aware of the timeline and be willing to be flexible.

This article will give you a general idea of how long it takes to close on a house in Chicago. We’ll discuss:

- How long does the actual closing take,

- How long does it take to close on a house and get the keys,

- How can you speed up the home closing process

How Long Does the Actual Closing Day Take?

Generally speaking, the actual closing day itself typically takes anywhere from around 40 minutes to a few hours.

The exact amount of time it takes to complete the transaction on the closing day can vary based on

- The nature and complexity of the transaction

- The availability and service level of the title company and lender personnel, and

- All parties having the necessary documents.

On the closing day, both the lender and the title company will want to ensure they have all the appropriate documents to ready for the buyer and seller to sign.

Also, having a great real estate lawyer ensures that any questions or unexpected problems during the closing process are resolved quickly.

What Happens On the Closing Day?

If you’re curious about what happens on closing day, it involves the home buyer and seller coming together to sign the closing papers that officially transfer ownership of the house from the buyer to the seller.

The home loan documents finalizing the buyer’s mortgage are signed as well.

Loan documents, such as the promissory note, mortgage and other lender documents, should be reviewed to ensure that the terms of your loan are what you agreed to with your lender.

Your real estate lawyer will be well-versed in these documents and can ensure that they are in order.

What should I bring to the Closing?

You should bring a valid driver’s license or other state ID to the closing.

If you’re the buyer,

- You will need to bring the balance of your down payment. These funds should be sent as a wire transfer, or, for amounts up to $50,000, a cashier’s check will also work.

If you’re the seller,

- Bring all keys to the property. You should bring any documents you may have signed prior to closing day as well.

Home Closing Process – Overview

- Generally, the real estate transaction begins when the home buyers make an offer.

- The buyers and sellers may then negotiate the terms, and once an agreement is reached, the buyer will begin the process of obtaining financing (if necessary).

- The buyer then orders an inspection of the property, and any significant issues are taken care.

- After that, the closing process begins in earnest, which requires work to be performed by the attorneys, title company, lender and realtors.

- Lastly, the actual closing is when the buyer gets the keys to the house and takes possession.

If you have a good real estate lawyer, they can help walk you through the process and avoid any issues that can delay closing.

Your lawyer will also advise you on any legal issues that come up during the process and help both parties satisfy any requirements that are unique to the specific transaction.

If you need help closing on a house in the Chicago area, don’t hesitate to contact us. We are happy to answer any questions and help the process go smoothly.

Step-by-Step Home Closing Process

1. Offer and negotiation:

The first step is to make an offer, once you find a house you want to buy. Learn more about How Long Does It Take To Close On A House After Offer Is Accepted?

This can include negotiating the price and any terms and conditions that need to be met before the sale can be finalized.

At the offer process, making the sale dependent on things like a home inspection, appraisal, and mortgage approval is common. These items are also referred to as contingencies.

2. Contingencies:

A contingency is a condition that must be met before the sale can be finalized.

Typical contingencies included in the purchase contract include a home inspection contingency, attorney review and approval, sufficient appraisal, mortgage approval, and a clear title.

These contingencies help protect both the buyer and the seller in the event that something unexpected comes up during the process.

3. Escrow:

Once all contingencies have been met, and the purchase price has been agreed upon, the next step is to open an escrow account.

An escrow account is a neutral third-party account that holds all the funds and documents related to the sale.

Initially, the earnest money will be deposited in escrow to be held until closing. This escrow may be held by a real estate broker, attorney, or the title company.

4. Home inspection:

A home inspection is usually a necessary condition of the contract to protect the buyer from unknown issues with the condition of the property.

An inspector will examine the property to identify any potential issues, such as structural damage or pest infestations. The inspector will provide you with a full home inspection report when he is done.

5. Repairs and renegotiation:

If any issues are found during the inspection, the buyer and seller may need to renegotiate the purchase price, agree to a repair credit, or make repairs before closing.

This can include repairs to the home’s foundation, electrical system, or roof. The buyer will have a chance to verify that all repairs have been made at the final walk through.

It is essential for both parties to have a clear understanding of what needs to be done, who will be responsible for the repairs, and the cost of the repairs before moving forward.

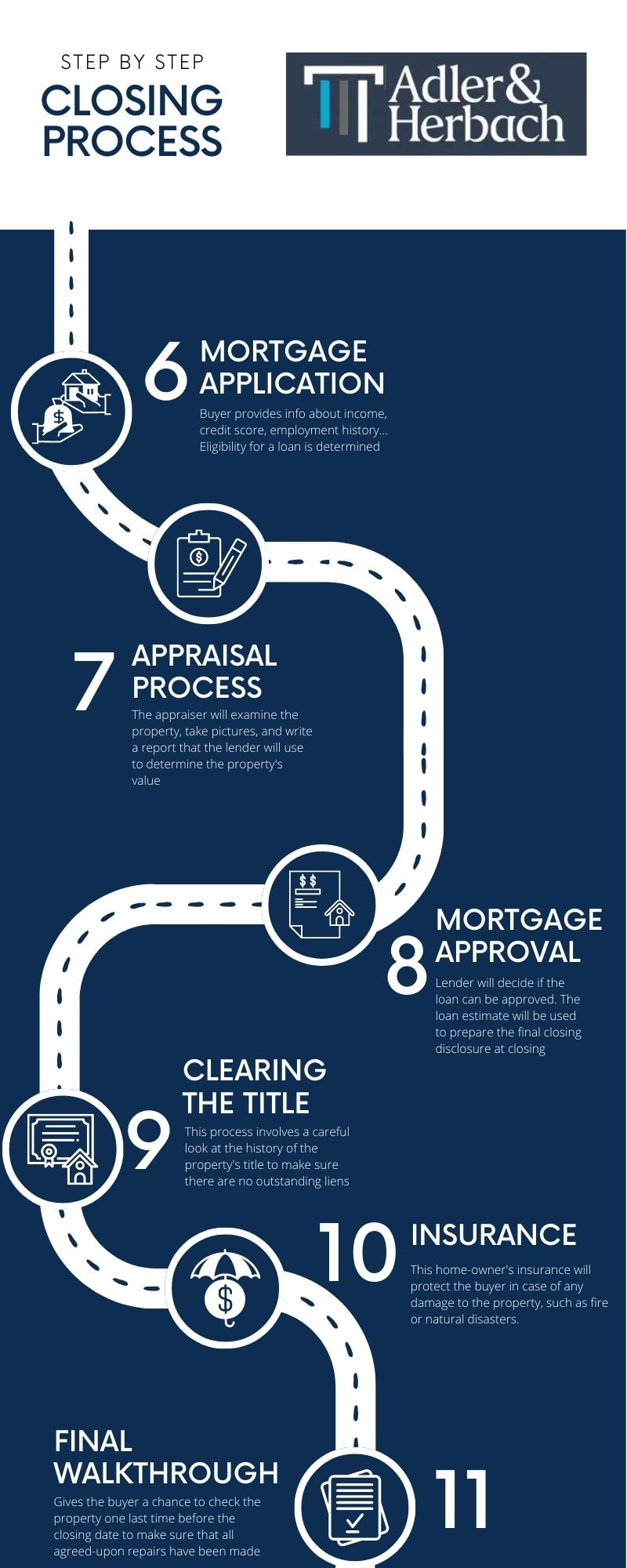

6. Mortgage Application

The next step in the home-buying process is the mortgage loan application.

Here, the buyer will have to provide the mortgage company with detailed information about their income, employment history, and credit score, among other things.

The lender will use this information to determine the buyer’s eligibility for a loan and to determine the terms of the loan, such as the interest rate, down payment and the term of the loan.

7. Appraisal process

The lender will order an appraisal of the property after the mortgage application has been submitted, thereby starting the appraisal process.

This appraisal is used to determine how much the property is worth on the market, which is one of the most important steps in the underwriting process.

The appraiser will examine the property, take pictures, and write a report that the lender will use to determine the property’s value.

8. Mortgage Approval

Once the appraisal is done, the lender will look at the buyer’s loan application, credit report, appraisal report, and all items provided by the buyer to decide if the loan is approved.

If the buyer is approved, the lender will give them a loan estimate that includes the interest rate, the monthly mortgage payment, and the closing costs.

The loan estimate will be used to prepare the final closing disclosure at closing.

What does clear to close mean?

“Clear to close” means your mortgage is ready to be funded and closed. It signifies that you have completed all necessary steps to prove your ability to afford the loan and that there are no issues with the property. Typically received a few days before the closing date, you can schedule a final walk-through and sign the closing documents. Clear to close is one of the last stages of obtaining a mortgage.

9. Clearing the Title

Before the closing can take place, the title of the property needs to be reviewed and cleared.

This process involves a careful look at the history of the property’s title to make sure there are no outstanding liens or other problems that could stop the sale.

Once the title is cleared, the buyer can proceed with the closing.

10. Obtaining Homeowner’s Insurance

It is a requirement for the buyer to have homeowner’s insurance in place before the closing.

This insurance will protect the buyer in case of any damage to the property, such as fire or natural disasters.

The buyer will also need homeowner’s insurance to protect the lender’s investment in the property.

11. Final Walkthrough

The final walkthrough is an essential step in the closing process.

It gives the buyer a chance to check the property one last time before the closing date to make sure that all agreed-upon repairs have been made and that the property is in the same condition as when the offer was accepted.

This step is typically done as close to the closing as possible, and it’s vital for the buyer to bring the inspection report to compare it against the property’s current condition.

Once the final walkthrough is complete and all parties are satisfied, the final paperwork can proceed.

12. Closing Paperwork

In preparation of closing paperwork, the closing agent will gather all of the necessary documents, such as the deed, mortgage loan document, closing disclosure, and all title documents.

The closing agent will also be responsible for disbursing funds to the appropriate parties and transfer the title to the new owner.

The closing process can be complex, but with the involvement of the right professionals, it can be a smooth and successful experience.

With the right team in place, you can navigate the closing process with confidence and ease, making the dream of homeownership a reality.

Call now & Get a Free Consultation!

Special Offer: Mention this website (Northsidelegal.com) and get a free consultation on your first Real estate attorney service!

How can I speed up the closing of my house?

Closing on a house typically requires a lot of work by various parties.

1. Start the loan process as soon as possible by getting pre-approved.

Getting pre-approved for a loan before you start making offers is a great way to ensure you have the best chance of getting the loan you need and being prepared to submit an attractive offer.

Pre-approval helps you understand the rate and amount you are eligible for, as well as any restrictions that may be associated with your loan.

- Gather all necessary documents for the loan application.

- These may include pay stubs, bank statements, tax returns, and other proof of your financial condition.

- Shop around for different lenders to compare loan terms.

- Check with banks and other financial institutions to get a better idea of the types of loans available (such as FHA loans) and the terms associated with them.

- Each lender has their own set of criteria for approving loans, so you should compare and contrast multiple lenders to determine which is the best fit for you.

- Check your credit score.

- A good credit score is usually above 650, so you should check yours prior to applying for a loan.

- You can purchase a report from a credit-monitoring agency or check your credit score for free through your local bank or credit union.

- Get pre-approved before you start looking at potential homes.

- It can help you negotiate the price of a home you’re interested in, and it can also help you determine how much you should be comfortable spending on a home.

- A pre-approval letter can also give you a substantial edge when bidding on a house.

2. Stay on top of communication

- Ensure all emails, voicemails, and other messages from the professionals assisting you in this process are answered promptly.

- Responding to all messages in a timely manner helps ensure that your purchase moves along quickly and helps maintain good communication between you, your agent, attorney and loan officer.

- Failing to respond promptly may cause delays and could even put the process on hold until the message is addressed.

- Stay organized and track emails, documents, and deadlines in one spot.

- This will ensure that no detail is overlooked and that the closing process is timely.

- Have your real estate agent, lawyer, and loan officer provide you with all necessary documents and timelines, and then make sure you track these documents and deadlines in a single, centralized location.

- You should also make notes as necessary and ask for clarification on anything that may be unclear.

- Have your real estate agent and loan officer communicate directly with each other.

- It can help streamline the process and keep everything on track.

- Have each party provide the other with any information needed to facilitate the purchase, such as names, account numbers, and closing documents.

- The closing process will go more smoothly if everyone communicates clearly and on time.

3. Be Flexible During the Loan Process

When you are trying to speed up the process of closing on your house, it is important to remain flexible throughout the mortgage process.

This means that if certain changes need to be made, you should be willing to modify the process to ensure it runs as smoothly and quickly as possible.

- Have patience during the pre-approval process.

- The pre-approval process for a loan can often take some time. Remain patient through this process and allow the mortgage lender to do their job.

- Also, stay on top of any paperwork or additional lender requests so that you can quickly send in the required documents.

- Be prepared to address any issues that come up during the loan process.

- This could include verifying certain documents or providing additional proof or information needed to proceed with the loan.

- Getting ahead of any problems that come up can help speed up the closing process.

4. Obtain Property Insurance

Make sure you have a new policy in place when you close on the new house.

- Shop around for the best terms you can find for property insurance. Keep in mind that not all insurance companies are equal, and the cheapest price may not always be the best option.

- Even if you are transferring a policy from a previous house, you should confirm that the new policy is in place with the correct coverage before closing day.

Closing costs on a House

Closing costs include all of the fees and expenses paid by a buyer and seller related to the real estate transaction.

These can include real estate agent commissions, mortgage loan fees, title fees, transfer taxes, attorneys’ fees, etc.

Here you can find a detailed analysis of closing costs in the Chicago market.

Congratulations

You should now be prepared to begin making offers and take your next step on the journey to home ownership better informed about each step from your initial offer until closing day.

Please feel free to reach out to one of our attorneys if you have any questions or if we can assist you in this process.